Question: D B D E F G H J K w NE 4 5 000 Biscuit Farm has a 8 year maturity bond with a par

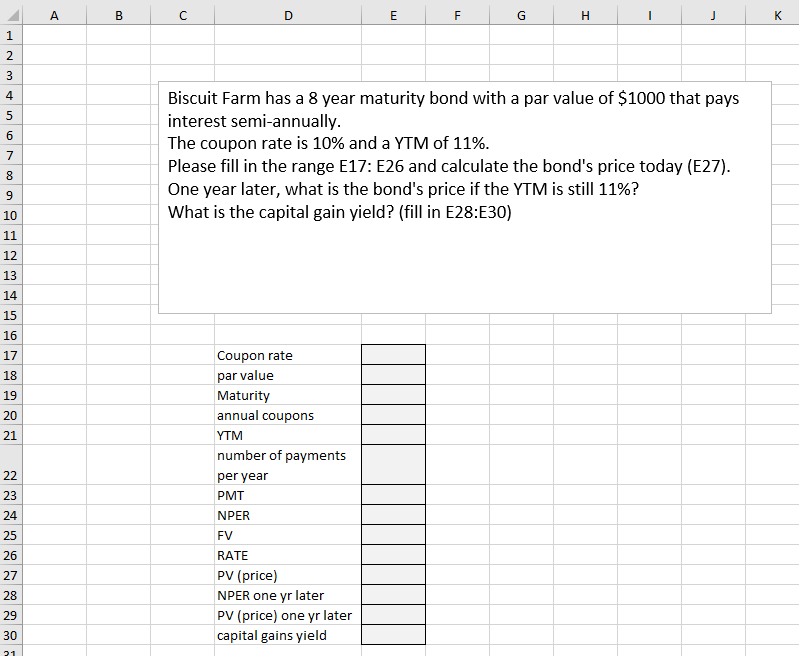

D B D E F G H J K w NE 4 5 000 Biscuit Farm has a 8 year maturity bond with a par value of $1000 that pays interest semi-annually. The coupon rate is 10% and a YTM of 11%. Please fill in the range E17: E26 and calculate the bond's price today (E27). One year later, what is the bond's price if the YTM is still 11%? What is the capital gain yield? (fill in E28:E30) 9mm BBa 17 18 19 22 23 Coupon rate par value Maturity annual coupons YTM number of payments per year PMT NPER FV RATE PV (price) NPER one yr later PV (price) one yr later capital gains yield 24 25 26 27 28 29 30 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts