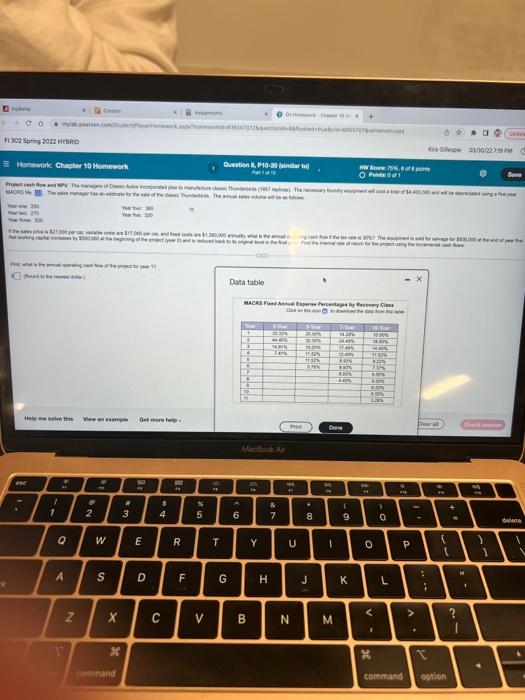

Question: D- Computer DO 71302 Spring 2022 HYBRID 022M = Homework Chapter 10 Homework Question Printer to www.por OP1 Prep for and why wy The we

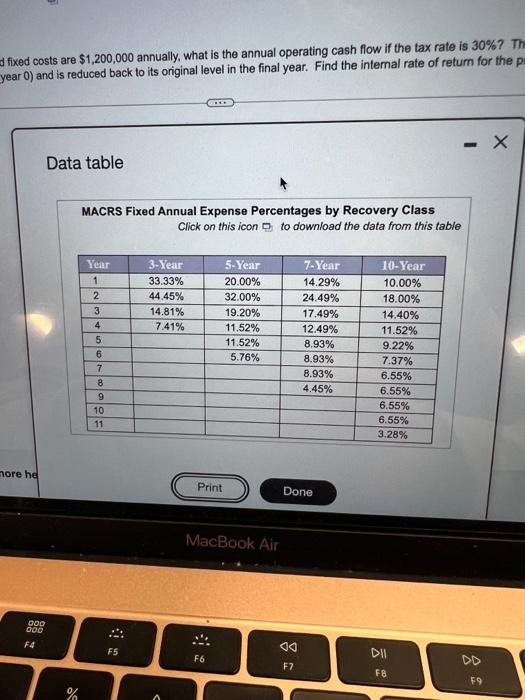

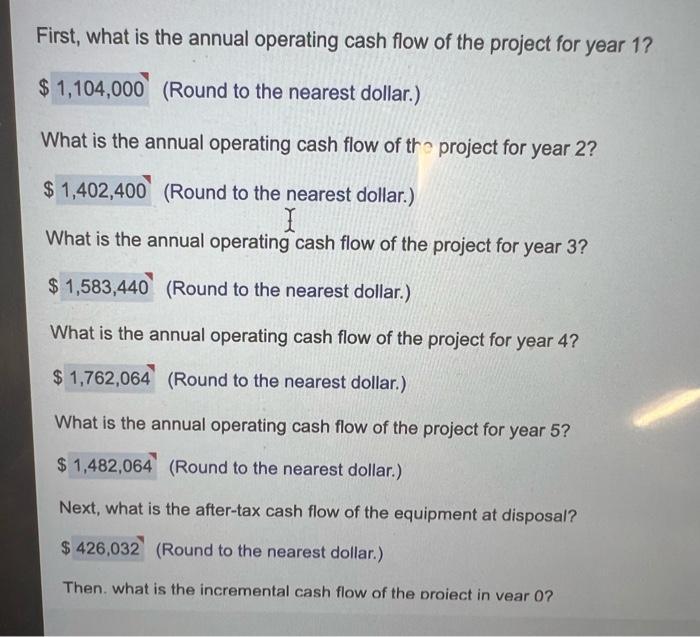

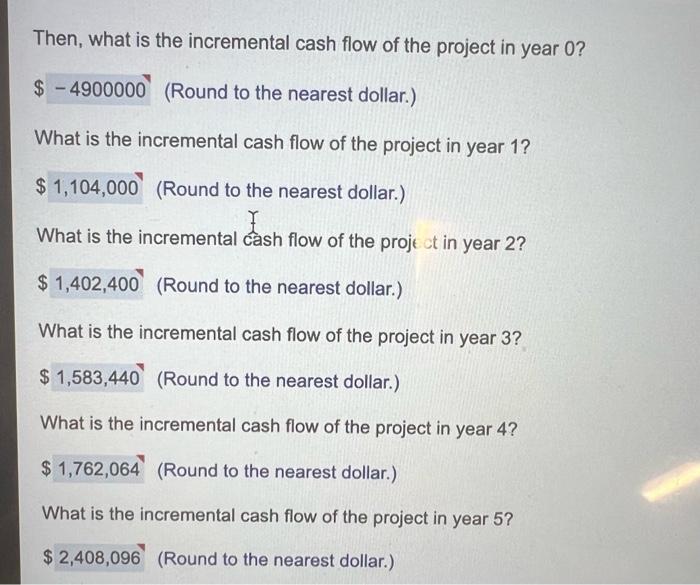

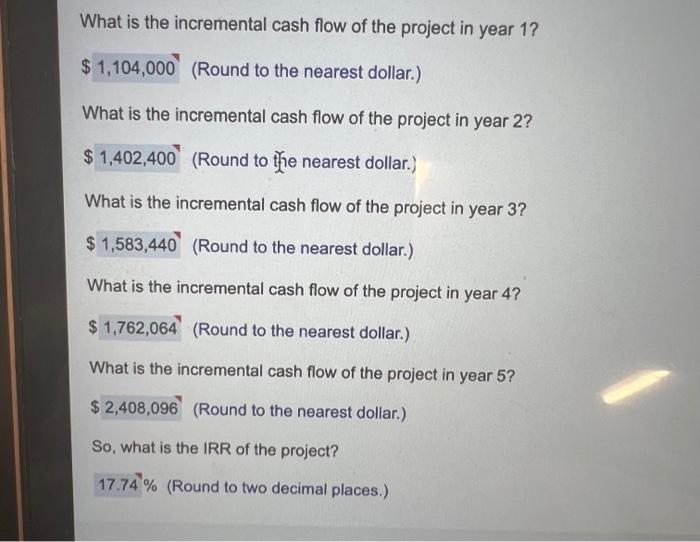

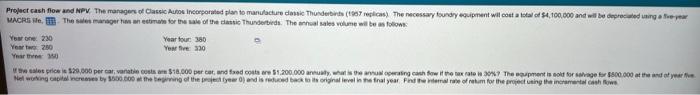

D- Computer DO 71302 Spring 2022 HYBRID 022M = Homework Chapter 10 Homework Question Printer to www.por OP1 Prep for and why wy The we Save . SS.. New Datatable MACRS APC De Wher Ihr 2007 so WON 2013 HON 12 COS ON BE WAN Home we this View Galeri Borg Mucook Air s 3 DO * : 1. * M 1 9 command Command option fixed costs are $1,200,000 annually, what is the annual operating cash flow if the tax rate is 30%? Th year 0) and is reduced back to its original level in the final year. Find the internal rate of return for the pa - X Data table MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table Year 1 2 3 ON 3-Year 33.33% 44.45% 14.81% 7.41% 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 6 7 8 9 10 11 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% more he Print Done MacBook Air 000 000 F4 00 F5 DII F6 F7 FB F9 % First, what is the annual operating cash flow of the project for year 1? $ 1,104,000 (Round to the nearest dollar.) What is the annual operating cash flow of the project for year 2? $ 1,402,400 (Round to the nearest dollar.) I What is the annual operating cash flow of the project for year 3? $ 1,583,440 (Round to the nearest dollar.) What is the annual operating cash flow of the project for year 4? $ 1,762,064 (Round to the nearest dollar.) What is the annual operating cash flow of the project for year 5? $ 1,482,064 (Round to the nearest dollar.) Next, what is the after-tax cash flow of the equipment at disposal? $ 426,032 (Round to the nearest dollar.) Then, what is the incremental cash flow of the proiect in vear 0? Then, what is the incremental cash flow of the project in year 0? $ - 4900000 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 1? $ 1,104,000 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 2? $ 1,402,400 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 3? $ 1,583,440 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 4? $ 1,762,064 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 5? $ 2,408,096 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 1? $ 1,104,000 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 2? $ 1,402,400 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 3? $ 1,583,440 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 4? $ 1,762,064 (Round to the nearest dollar.) What is the incremental cash flow of the project in year 5? $ 2,408,096 (Round to the nearest dollar.) So, what is the IRR of the project? 17.74% (Round to two decimal places.) Project cash flow and NPV The managers of Classic Autos Incorporated plan to manufacture donne Thunderbird (4887 recom) The necessary tunay nant will cost a total of 54,100,000 and wir be deprecated ang MACRS, These manager man estimate for the sale of the stic Thunderbirds. The anal sales volume will be as follows Your one. 230 Year four 380 Yeartwe 200 You fee: 30 Yearth We price is $20,000 per car, variatie costs $18,000 per cand doar 1.200.000 aray, what the wing cash fow it the rate is 30%? The woment is oorsage for $800.000 at the end of year the Nel winger by 30. the beging of the year and is back to original level in the final year Find alate of rem for the ring the incremental che

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts