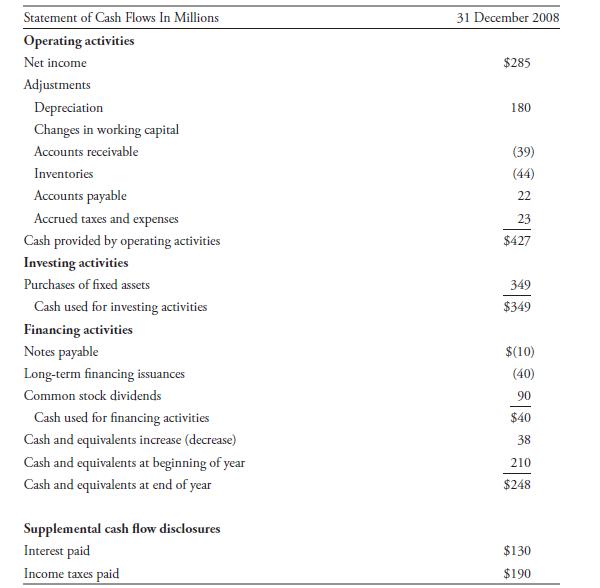

Question: For LaForge Systems, whose financial statements are given in Problem 2, show the adjustments from the current levels of CFO (which is $427 million), EBIT

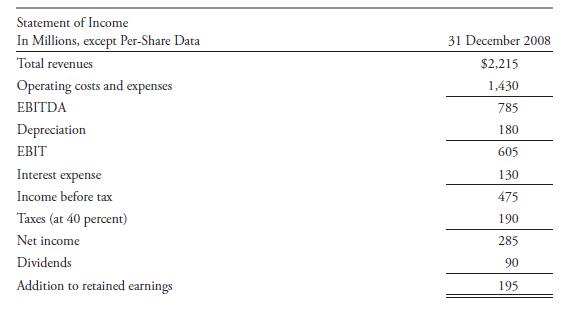

For LaForge Systems, whose financial statements are given in Problem 2, show the adjustments from the current levels of CFO (which is $427 million), EBIT ($605 million), and EBITDA ($785 million) to find:

A. FCFF.

B. FCFE.

Data From Problem 2:-

LaForge Systems, Inc. has net income of $285 million for the year 2008. Using information from the company’s financial statements given here, show the adjustments to net income that would be required to find:

A. FCFF.

B. FCFE.

C. In addition, show the adjustments to FCFF that would result in FCFE.

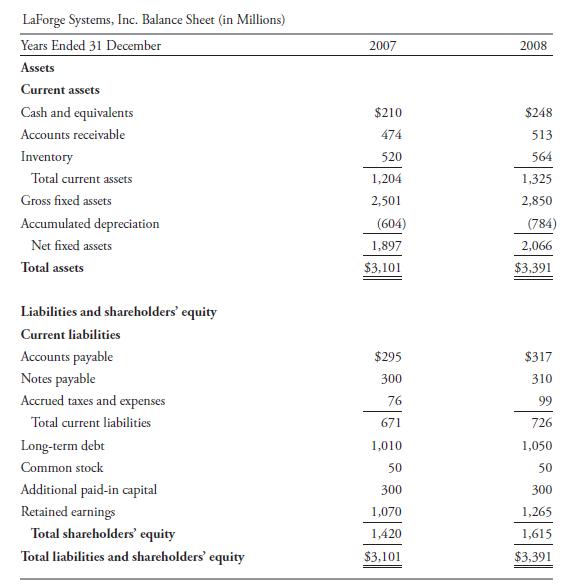

LaForge Systems, Inc. Balance Sheet (in Millions) Years Ended 31 December Assets Current assets Cash and equivalents Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and shareholders' equity 2007 2008 $210 $248 474 513 520 564 1,204 1,325 2,501 2,850 (604) (784) 1,897 2,066 $3,101 $3,391 Current liabilities Accounts payable $295 $317 Notes payable 300 310 Accrued taxes and expenses 76 99 Total current liabilities 671 726 Long-term debt 1,010 1,050 Common stock 50 50 Additional paid-in capital 300 300 Retained earnings 1,070 1,265 Total shareholders' equity 1,420 1,615 Total liabilities and shareholders' equity $3,101 $3,391

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

To calculate Free Cash Flow to the Firm FCFF and Free Cash Flow to Equity FCFE well use the followin... View full answer

Get step-by-step solutions from verified subject matter experts