Question: (d) (e) While you are browsing the bank's website, you find that DBS quotes an interest rate of 1.6% per annum on a car

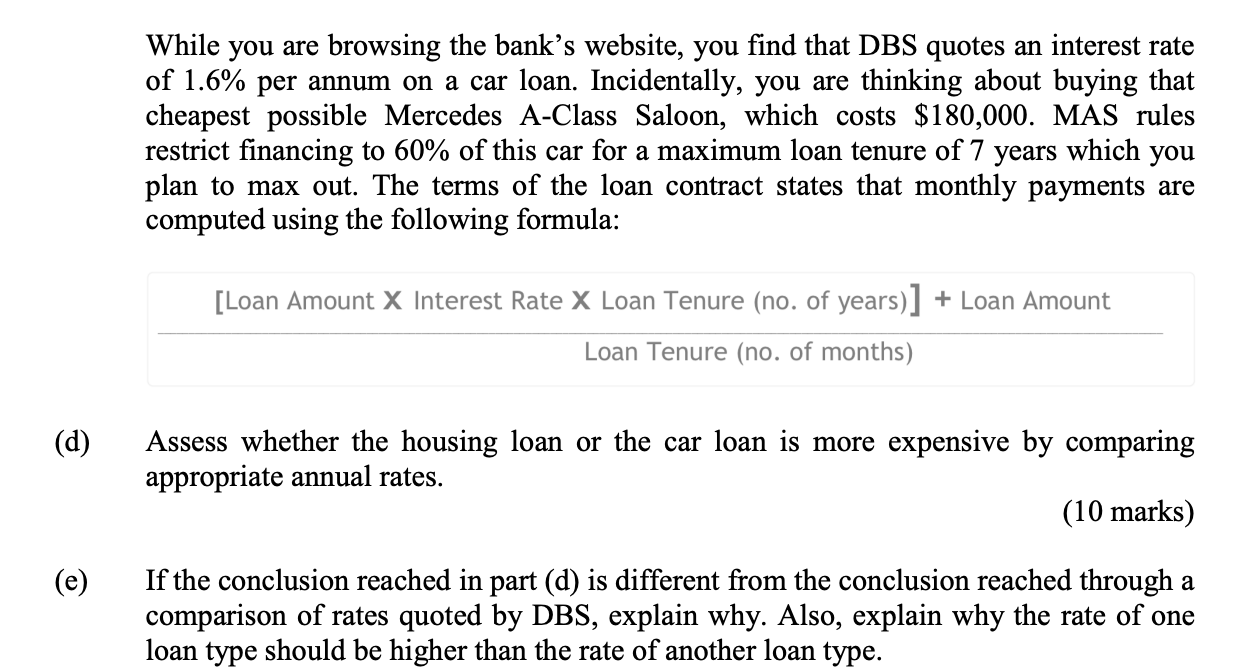

(d) (e) While you are browsing the bank's website, you find that DBS quotes an interest rate of 1.6% per annum on a car loan. Incidentally, you are thinking about buying that cheapest possible Mercedes A-Class Saloon, which costs $180,000. MAS rules restrict financing to 60% of this car for a maximum loan tenure of 7 years which you plan to max out. The terms of the loan contract states that monthly payments are computed using the following formula: [Loan Amount X Interest Rate X Loan Tenure (no. of years)] + Loan Amount Loan Tenure (no. of months) Assess whether the housing loan or the car loan is more expensive by comparing appropriate annual rates. (10 marks) If the conclusion reached in part (d) is different from the conclusion reached through a comparison of rates quoted by DBS, explain why. Also, explain why the rate of one loan type should be higher than the rate of another loan type.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts