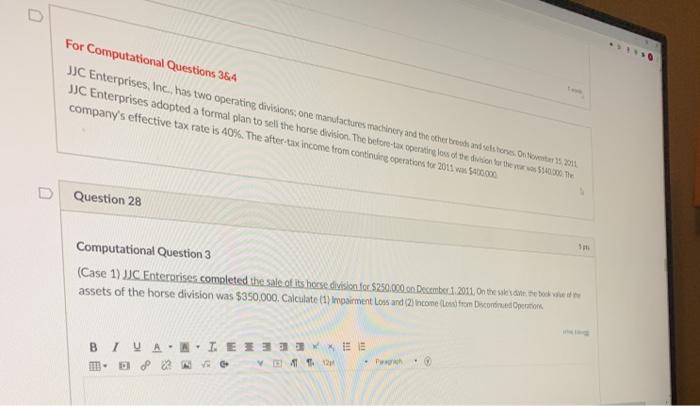

Question: D . For Computational Questions 384 JC Enterprises, Inc., has two operating divisions, one mandactures machinery and the other teremth and sels hers. On tewater

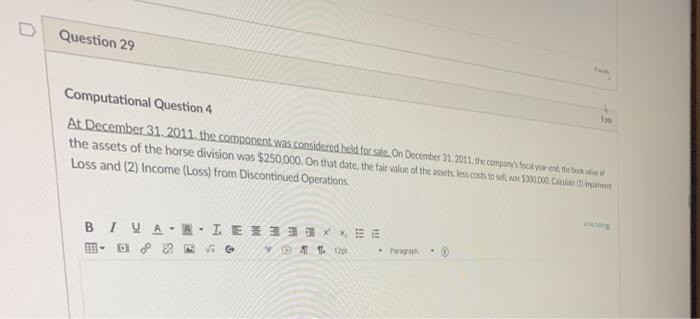

D . For Computational Questions 384 JC Enterprises, Inc., has two operating divisions, one mandactures machinery and the other teremth and sels hers. On tewater JJC Enterprises adopted a formal plan to sell the horse dision. The before-tex operation on ch the division to the ver van 12.00. The company's effective tax rate is 40%. The after-tax income from contiente operatora tor 2013 $48.00 Question 28 Computational Question 3 (Case 1) JJC Enterprises completed the sale of its horse division for $250.000 on December 1, 2011. On the second, te dok se ne assets of the horse division was $350,000. Calculate (1) impairment Loss and 2 income Loan trom Discontinued Operations, BIVA. NIEaa VA12 Question 29 Computational Question 4 At December 31, 2011. the component was considered held for sale. On December 31, 2011, dhe company's heck your ene the behavia de the assets of the horse division was $250,000. On that date, the fair value of the assets, les costs to sel, was $300,000. Colette breatment Loss and (2) Income (Loss) from Discontinued Operations BIVALEZ.** VO11201 D . For Computational Questions 384 JC Enterprises, Inc., has two operating divisions, one mandactures machinery and the other teremth and sels hers. On tewater JJC Enterprises adopted a formal plan to sell the horse dision. The before-tex operation on ch the division to the ver van 12.00. The company's effective tax rate is 40%. The after-tax income from contiente operatora tor 2013 $48.00 Question 28 Computational Question 3 (Case 1) JJC Enterprises completed the sale of its horse division for $250.000 on December 1, 2011. On the second, te dok se ne assets of the horse division was $350,000. Calculate (1) impairment Loss and 2 income Loan trom Discontinued Operations, BIVA. NIEaa VA12 Question 29 Computational Question 4 At December 31, 2011. the component was considered held for sale. On December 31, 2011, dhe company's heck your ene the behavia de the assets of the horse division was $250,000. On that date, the fair value of the assets, les costs to sel, was $300,000. Colette breatment Loss and (2) Income (Loss) from Discontinued Operations BIVALEZ.** VO11201

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts