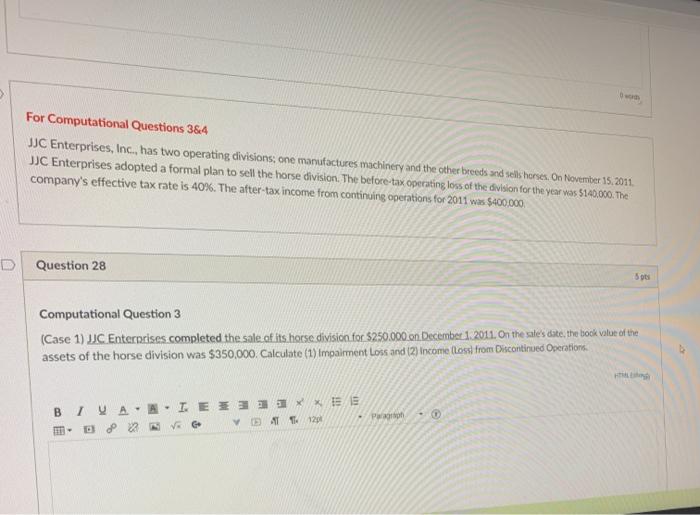

Question: For Computational Questions 384 JJC Enterprises, Inc., has two operating divisions, one manufactures machinery and the other breeds and sells horses. On November 15, 2011

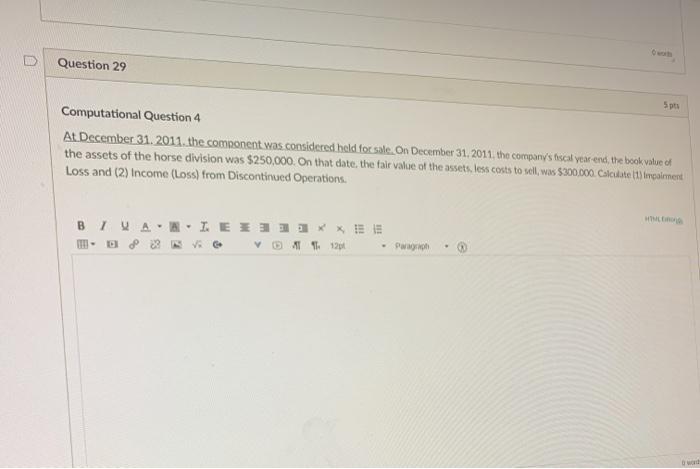

For Computational Questions 384 JJC Enterprises, Inc., has two operating divisions, one manufactures machinery and the other breeds and sells horses. On November 15, 2011 JJC Enterprises adopted a formal plan to sell the horse division. The before-tax operating loss of the division for the year was 5140,000. The company's effective tax rate is 40%. The after-tax income from continuing operations for 2011 was $400,000 D Question 28 Spo Computational Question 3 (Case 1) JC Enterprises completed the sale of its horse division for $250.000 on December 1, 2011. On the sate's date, the book value of the assets of the horse division was $350,000. Calculate (1) Impairment Loss and (2) Income (ose from Discontinued Operations. BI . IE *** * M 4 12 P Question 29 5 pts Computational Question 4 At December 31, 2011, the component was considered held for sale. On December 31, 2017, the company's fiscal year end, the book value of the assets of the horse division was $250,000. On that date, the tale value of the assets. less costs to sell, was $300,000 Calculate it aiment Loss and (2) Income (Loss) from Discontinued Operations. BIWA A -LEX & 1 12 . Po

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts