Question: D H w N 5 . B E F G 9 Problem 1 0 In order to increase production capacity, Ventures Inc. is considering replacing

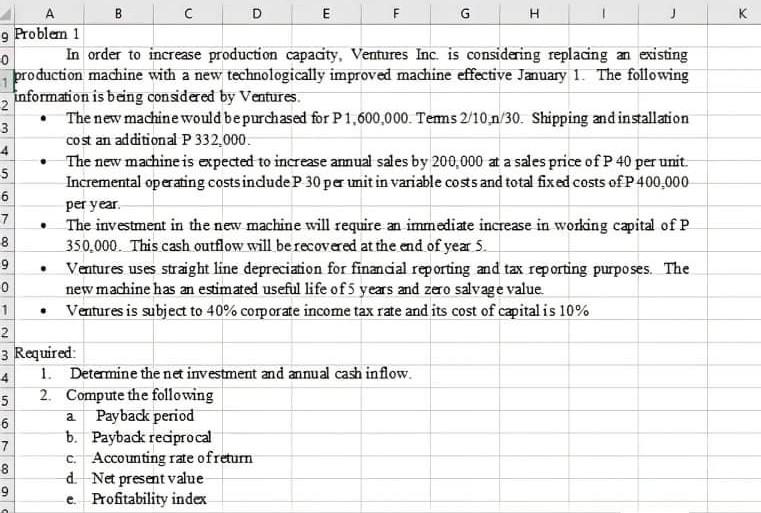

D H w N 5 . B E F G 9 Problem 1 0 In order to increase production capacity, Ventures Inc. is considering replacing an existing production machine with a new technologically improved machine effective January 1. The following 2 information is being considered by Ventures. 3 The new machine would be purchased for P1,600,000. Tems 2/10 n/30. Shipping and installation cost an additional P 332,000. 4 The new machine is expected to increase annual sales by 200,000 at a sales price of P 40 per unit. Incremental operating costs indude P 30 per unit in variable costs and total fixed costs of P 400.000 6 per year. 7 The investment in the new machine will require an immediate increase in working capital of P 8 350.000. This cash outflow will be recovered at the end of year 5. 9 Ventures uses straight line depreciation for financial reporting and tax reporting purposes. The new machine has an estimated useful life of 5 years and zero salvage value. 1 Ventures is subject to 40% corporate income tax rate and its cost of capital is 10% 2 3 Required: 1. Determine the net investment and annual cash inflow. 2. Compute the following a Payback period 7 b. Payback reciprocal 8 c. Accounting rate ofretum d. Net present value e Profitability index . min 00 6 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts