Question: Part B - Case Study Questions (Total: 20 marks) Question 7 (10 marks) Anna is a resident of Australia for tax purposes. On 1 Feb

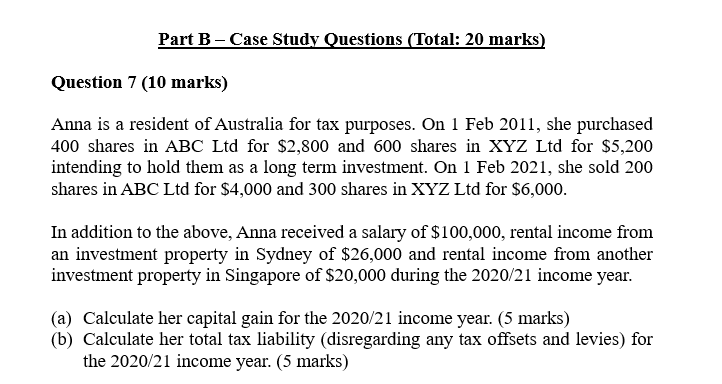

Part B - Case Study Questions (Total: 20 marks) Question 7 (10 marks) Anna is a resident of Australia for tax purposes. On 1 Feb 2011, she purchased 400 shares in ABC Ltd for $2,800 and 600 shares in XYZ Ltd for $5,200 intending to hold them as a long term investment. On 1 Feb 2021, she sold 200 shares in ABC Ltd for $4,000 and 300 shares in XYZ Ltd for $6,000. In addition to the above, Anna received a salary of $100,000, rental income from an investment property in Sydney of $26,000 and rental income from another investment property in Singapore of $20,000 during the 2020/21 income year. (a) Calculate her capital gain for the 2020/21 income year. (5 marks) (b) Calculate her total tax liability (disregarding any tax offsets and levies) for the 2020/21 income year. (5 marks) Part B - Case Study Questions (Total: 20 marks) Question 7 (10 marks) Anna is a resident of Australia for tax purposes. On 1 Feb 2011, she purchased 400 shares in ABC Ltd for $2,800 and 600 shares in XYZ Ltd for $5,200 intending to hold them as a long term investment. On 1 Feb 2021, she sold 200 shares in ABC Ltd for $4,000 and 300 shares in XYZ Ltd for $6,000. In addition to the above, Anna received a salary of $100,000, rental income from an investment property in Sydney of $26,000 and rental income from another investment property in Singapore of $20,000 during the 2020/21 income year. (a) Calculate her capital gain for the 2020/21 income year. (5 marks) (b) Calculate her total tax liability (disregarding any tax offsets and levies) for the 2020/21 income year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts