Question: d in Drive 45. Given a set of present value tables, an annual interest rate, the dollar amount of equal payments made, and the number

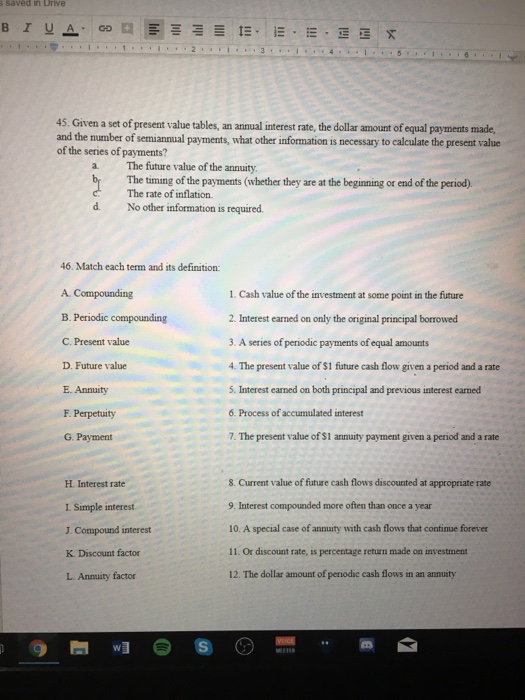

d in Drive 45. Given a set of present value tables, an annual interest rate, the dollar amount of equal payments made, and the number of semiannual payments, what other information is necessary to calculate the present value of the series of payments? a. The future value of the annuity The timing of the payments (whether they are at the beginning or end of the period) The rate of inflation. d. No other information is required. 46. Match each term and its definition B. Periodic compounding C. Present value D. Future value E. Annuity F. Perpetuity G. Payment 1. Cash value of the investment at some point in the future 2. Interest earned on only the original principal borrowed 3. A series of periodic payments of equal amounts 4. The present value of $1 future cash flow given a period and a rate 5. Interest earned on both principal and previous interest earned 6. Process of accumulated interest 7. The present value of $1 annuity payment given a period and a rate H Interest rate I Simple interest J. Compound interest K. Discount factor L. Annuity factor 8. Current value of future cash flows discounted at appropriate rate 9. Interest compounded more often than once a year 10. A special case of annuity with cash flows that continue forever 11. Or discount rate, is percentage return made on investment 12The dollar amount of penodse cash flows in an annuity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts