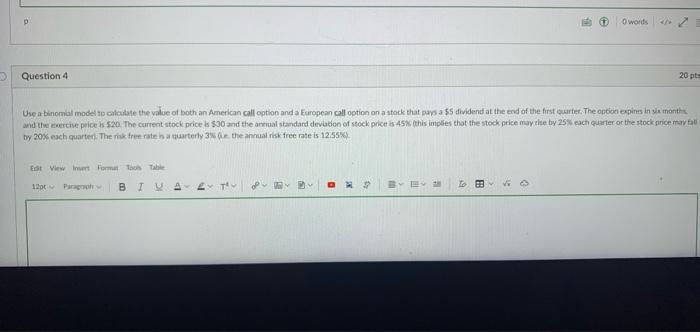

Question: D o words Question 4 20 pts Use a binomial model to calculate the value of both an American call option and a European call

D o words Question 4 20 pts Use a binomial model to calculate the value of both an American call option and a European call option on a stack that pays a $dividend at the end of the first quarter. The option expires in a month and the exercise price is $20. The current stock price is $30 and the annual standard deviation of stock price is 45% (this implies that the stock price marie by 25cach quarter or the stock price mayo by 20% each quarter. The risk free rate a quarterly 3 the annual risk free rate is 12:55 Et View It For The 2 P X E 9 IP 5 > D o words Question 4 20 pts Use a binomial model to calculate the value of both an American call option and a European call option on a stack that pays a $dividend at the end of the first quarter. The option expires in a month and the exercise price is $20. The current stock price is $30 and the annual standard deviation of stock price is 45% (this implies that the stock price marie by 25cach quarter or the stock price mayo by 20% each quarter. The risk free rate a quarterly 3 the annual risk free rate is 12:55 Et View It For The 2 P X E 9 IP 5 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts