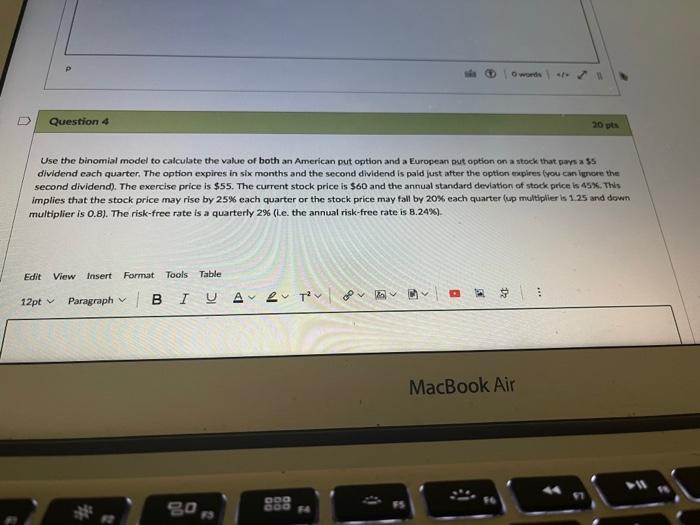

Question: Question 4 20 pts Use the binomial model to calculate the value of both an American put option and a European put option on a

Question 4 20 pts Use the binomial model to calculate the value of both an American put option and a European put option on a stock that ways a $ dividend each quarter. The option expires in six months and the second dividend is paid just after the option expires you can govore the second dividend). The exercise price is $55. The current stock price is $60 and the annual standard deviation of stock price is 45%. This implies that the stock price may rise by 25% each quarter or the stock price may fall by 20% each quarter (up multiplier is 125 and down multiplier is 0.8). The risk-free rate is a quarterly 2% (e. the annual risk-free rate is 8.24%). Edit View Insert Format Tools Table 12pt Paragraph BI Averrou oor MacBook Air DOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts