Question: D Question 1 1 pts What is the 2y2y implied forward rate? Answer the question as a percentage rounded to 2 decimal places (e.g., 10.25%

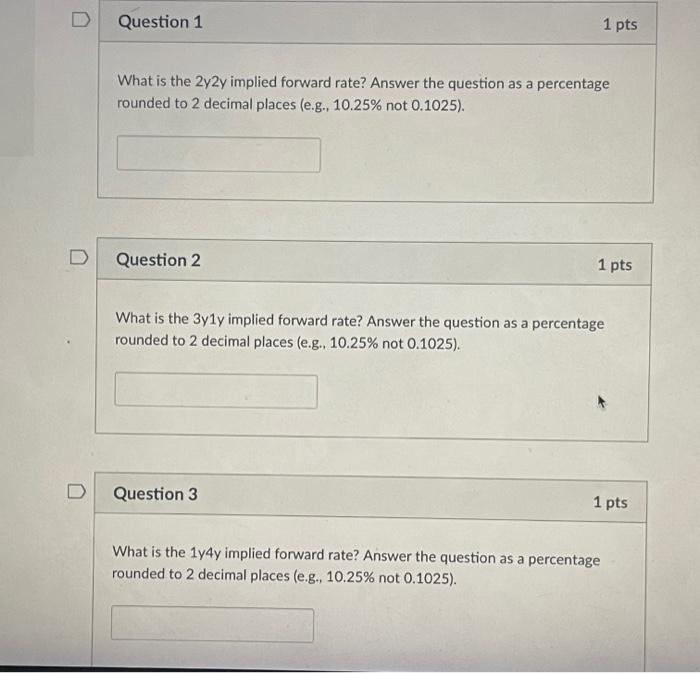

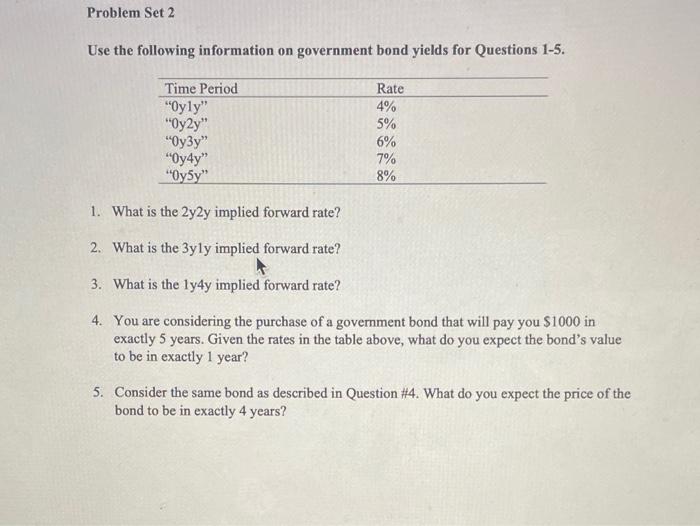

D Question 1 1 pts What is the 2y2y implied forward rate? Answer the question as a percentage rounded to 2 decimal places (e.g., 10.25% not 0.1025). Question 2 1 pts What is the 3yly implied forward rate? Answer the question as a percentage rounded to 2 decimal places (e.g., 10.25% not 0.1025). D Question 3 1 pts What is the 1y4y implied forward rate? Answer the question as a percentage rounded to 2 decimal places (e.g., 10.25% not 0.1025). Problem Set 2 Use the following information on government bond yields for Questions 1-5. Time Period "Oyly" "Oy2y" "Oy3y" "Oy4y" "Oy5y" Rate 4% 5% 6% 7% 8% 1. What is the 2y2y implied forward rate? 2. What is the 3yly implied forward rate? 3. What is the ly4y implied forward rate? 4. You are considering the purchase of a government bond that will pay you $1000 in exactly 5 years. Given the rates in the table above, what do you expect the bond's value to be in exactly 1 year? 5. Consider the same bond as described in Question #4. What do you expect the price of the bond to be in exactly 4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts