Question: Can you please provide me a step by step guide on how to solve these financial problems including which formulas to use and why? I

Can you please provide me a step by step guide on how to solve these financial problems including which formulas to use and why? I am trying to learn which formulas to use in these examples and am confused on what process I should use. Can you please assist and also provide a link where I can download the excel spreadsheet? Thank you!

Can you please provide a spreadsheet with the values as well? Please do not skip steps, i am trying to learn, thank you!

?

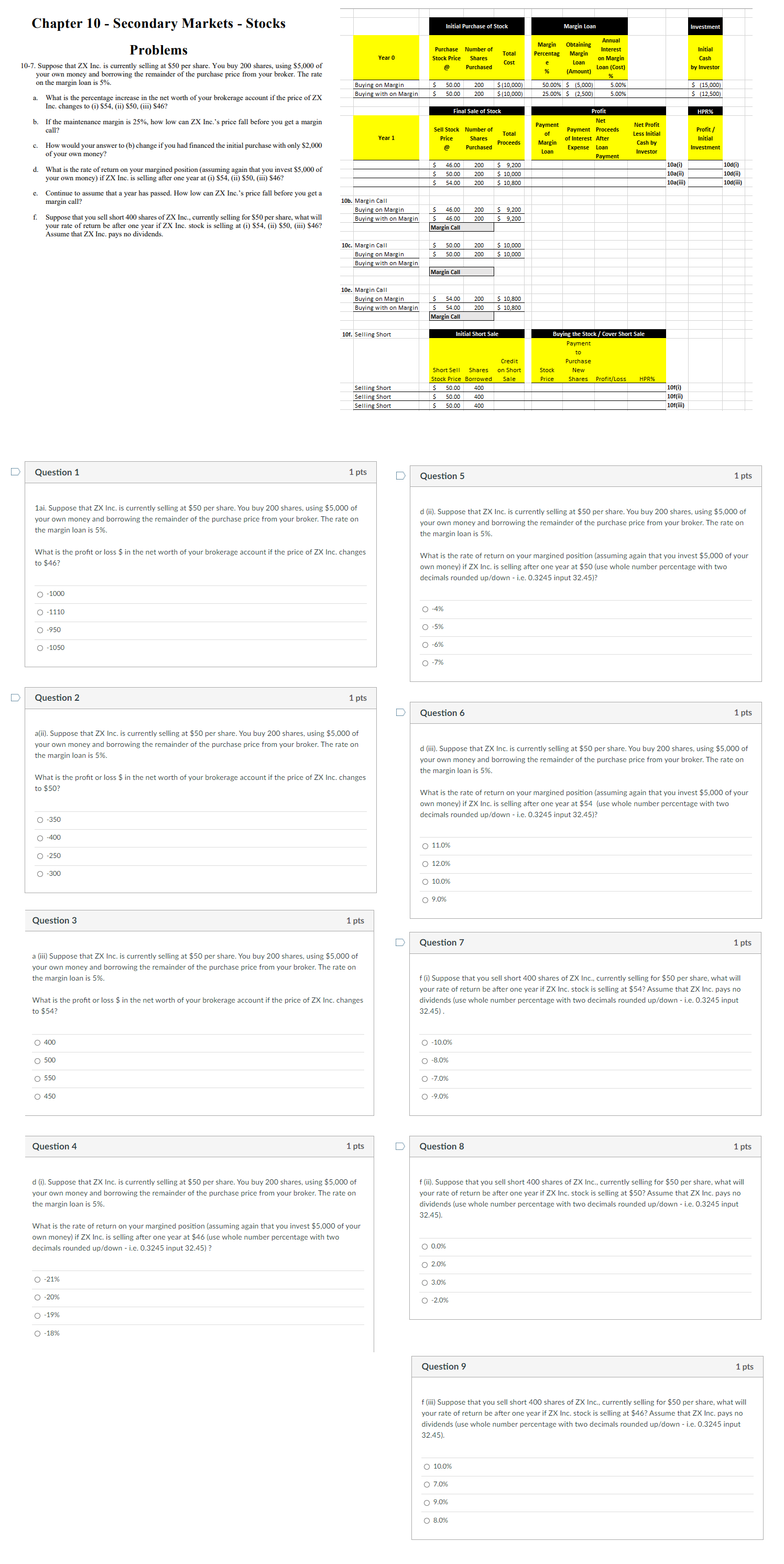

Chapter 10 - Secondary Markets - Stocks Initial Purchase of Stock Margin Loan ivestment Margin Obtaining Annual Problems Purchase Number of Interest Year 0 tock Price Shares Total Percentag Margin Initial 10-7. Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of Cost Loan on Margin Purchased Loan (Cost) by Investor your own money and borrowing the remainder of the purchase price from your broker. The rate (Amount) on the margin loan is 5%. Buying on Margin 50.00 200 5 (10,000) 50.00% S (5,000) 5.00% S (15,000) a. What is the percentage increase in the net worth of your brokerage account if the price of ZX uying with on Margin S 50.00 200 $ (10,000) 25.00% S (2,500) 5.00% S (12,500) Inc. changes to (i) $54, (ii) $50, (iii) $46? Final Sale of Stock Profit HPR . If the maintenance margin is 25%, how low can ZX Inc.'s price fall before you get a margin call? ell Stock Number of Payment Net Net Profit shares Total of Payment Proceeds Less Initial Profit Year 1 Price Share's Proceeds of your own money? Purchased Cash by Initial How would your answer to (b) change if you had financed the initial hase with only $2,000 Margin of Interest Afte Loan Expense Loan Payment Investor Investment What is the rate of return on your margined position (assuming again that you invest $5,000 of 0 200 5 9,200 10a(i) ()POT your own money) if ZX Inc. is selling after one year at (i) $54, (ii) $50, (iii) $46? 5 50.00 200 5 10,000 10a(ii) 10d(ii) $ 54.00 200 5 10,800 10a(iii) 10d(iii) tinue to assume that a year has passed. How low can ZX Inc.'s price fall before you get a margin call? ob. Margin Call Buying on Margin 200 5 9,200 Suppose that you sell short 400 shares of ZX Inc., currently selling for $50 per share, what will Buying with on Margin 200 5 9,200 your rate of return be after one year if ZX Inc. stock is selling at (i) $54, (ii) $50, (iii) $46? 46.00 Margin Call Assume that ZX Inc. pays no dividends. 10c. Margin Call S 50.00 200 5 10,000 Buying on Margin $ 50.00 200 $ 10,000 Buying with on Margin Margin Call 10e. Margin Call Buying on Margin $ 54.00 200 $ 10,800 Buying with on Margin 54.00 200 5 10,800 Margin Call 10f. Selling Short Initial Short Sale Buying the Stock / Cover Short Sale Payment Credit urchas Short Sell Shares on Short Stock Stock Price Borrowed Sale Price Shares Profit/Loss HPRX Selling Short 50.00 400 10f(i) Selling Short 50.00 400 10f(ii) Selling Short 50.00 400 1of(iii) D Question 1 1 pts D Question 5 1 pts 1ai. Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of your own money and borrowing the remainder of the purchase price from your broker. The rate on d (ii). Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of your own money and borrowing the remainder of the purchase price from your broker. The rate on the margin loan is 5%. the margin loan is 5%. What is the profit or loss $ in the net worth of your brokerage account if the price of ZX Inc. changes What is the rate of return on your margined position (assuming again that you invest $5,000 of your to $46? own money) if ZX Inc. is selling after one year at $50 (use whole number percentage with two decimals rounded up/down - i.e. 0.3245 input 32.45)? O -1000 O -1110 -4% O -950 O -5% O -1050 0 - 65 O -79 D Question 2 1 pts D Question 6 1 pts a(ii). Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of your own money and borrowing the remainder of the purchase price from your broker. The rate on d (iii). Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of the margin loan is 5%. your own money and borrowing the remainder of the purchase price from your broker. The rate on What is the profit or loss $ in the net worth of your brok e account if the price of ZX Inc. changes the margin loan is 5%. to $50? What is the rate of return on your margined position (assuming again that you invest $5,000 of your own money) if ZX Inc. is selling after one year at $54 (use whole number percentage with two O -350 decimals rounded up/down - i.e. 0.3245 input 32.45)? O -400 11.0% O -250 12.0% O -300 10.0% 0 9.0% Question 3 1 pts D Question 7 1 pts a (iii) Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of your own money and borrowing the remainder of the purchase price from your broker. The rate on the margin loan is 5% f (i) Suppose that you sell short 400 shares of ZX Inc., currently selling for $50 per share, what will your rate of return be after one year if ZX Inc. stock is selling at $54? Assume that ZX Inc. pays no What is the profit or loss $ in the net worth of your brokerage account if the price of ZX Inc. changes dividends (use whole number percentage with two decimals rounded up/down - i.e. 0.3245 input to $54? 32.45) . O 400 O -10.0% 500 -8.0% O 550 O -7.09 450 O -9.0% Question 4 1 pts D Question 8 1 pts d (i). Suppose that ZX Inc. is currently selling at $50 per share. You buy 200 shares, using $5,000 of f (ii). Suppose that you sell short 400 shares of ZX Inc., currently selling for $50 per share, what will your own money and borrowing the remainder of the purchase price from your broker. The rate on your rate of return be after one year if ZX Inc. stock is selling at $50? Assume that ZX Inc. pays no the margin loan is 5%. dividends (use whole number percentage with two decimals rounded up/down - i.e. 0.3245 input 32.45). What is the rate of return on your margined position (assuming again that you invest $5,000 of your own money) if ZX Inc. is selling after one year at $46 (use whole number percentage with two decimals rounded up/down - i.e. 0.3245 input 32.45) ? O 0.0% O 2.0%% O -21% O 3.0% O -20% O -2.0% O -19% O -18% Question 9 1 pts f (iii) Suppose that you sell short 400 shares of ZX Inc., currently selling for $50 per share, what will your rate of return be after one year if ZX Inc. stock is selling at $46? Assume that ZX Inc. pays no dividends (use whole number percentage with two decimals rounded up/down - i.e. 0.3245 input 32.45) 10.0% 7.0% O 9.0 8.0%