Question: D Question 1 10 pts Capital investment analysis is used to evaluate long term investment options. True O False Question 2 10 pts Capital investment

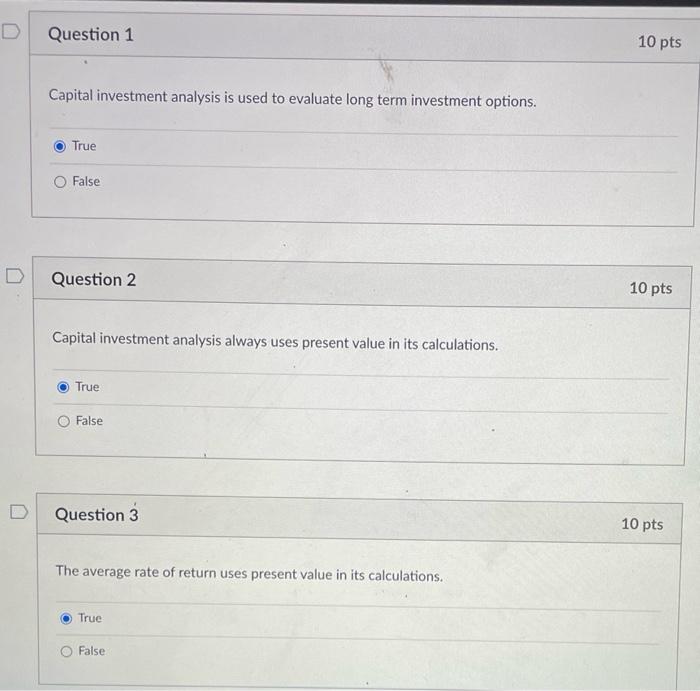

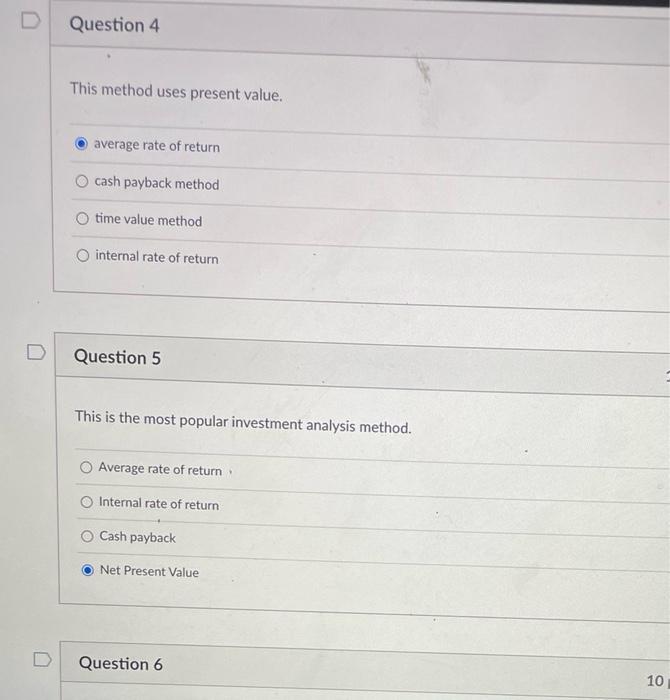

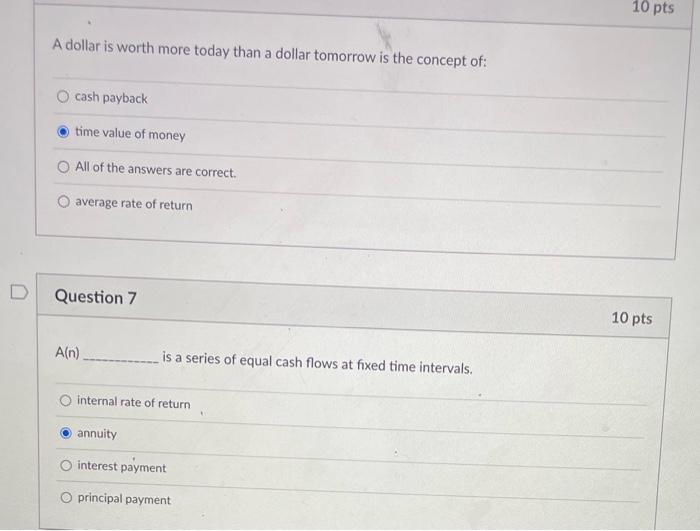

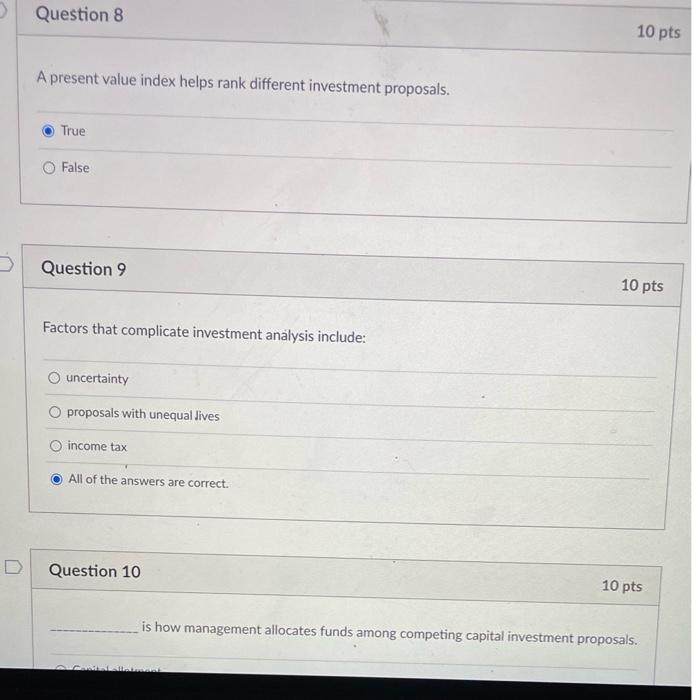

D Question 1 10 pts Capital investment analysis is used to evaluate long term investment options. True O False Question 2 10 pts Capital investment analysis always uses present value in its calculations. True False Question 3 10 pts The average rate of return uses present value in its calculations. True O False D Question 4 This method uses present value. average rate of return cash payback method time value method internal rate of return D Question 5 This is the most popular investment analysis method. Average rate of return Internal rate of return O Cash payback Net Present Value D Question 6 10 10 pts A dollar is worth more today than a dollar tomorrow is the concept of: O cash payback time value of money O All of the answers are correct. O average rate of return D Question 7 10 pts Aln is a series of equal cash flows at fixed time intervals. internal rate of return annuity interest payment O principal payment Question 8 10 pts A present value index helps rank different investment proposals. True O False Question 9 10 pts Factors that complicate investment analysis include: Ouncertainty O proposals with unequal lives income tax All of the answers are correct. Question 10 10 pts is how management allocates funds among competing capital investment proposals. D Question 10 10 pts is how management allocates funds among competing capital investment proposals. Capital allotment O Proposal analysis Internal rate of return Capital rationing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts