Question: D | Question 11 2 pts True or False, using the information from Table 1 and evaluating it using the Dupont identity, the financial analyst

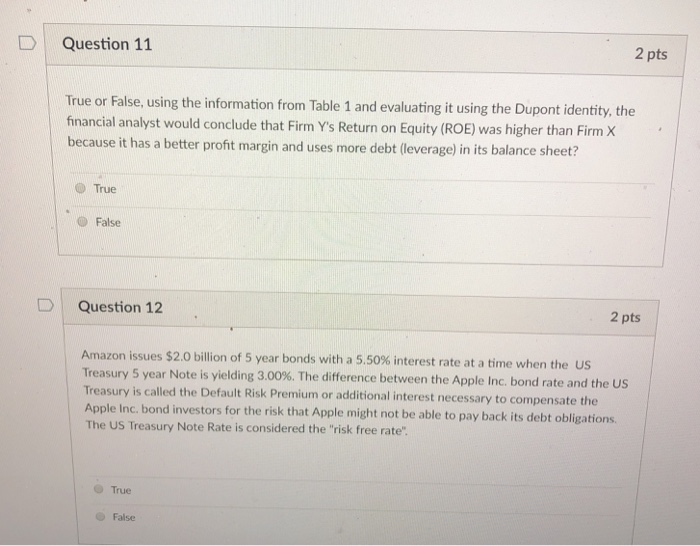

D | Question 11 2 pts True or False, using the information from Table 1 and evaluating it using the Dupont identity, the financial analyst would conclude that Firm Y's Return on Equity (ROE) was higher than Firm X because it has a better profit margin and uses more debt (leverage) in its balance sheet? True False D Question 12 2 pts Amazon issues $2.0 billion of 5 year bonds with a 5.50% interest rate at a time when the US Treasury 5 year Note is yielding 3.00%. The difference between the Apple Inc. bond rate and the US Treasury is called the Default Risk Premium or additional interest necessary to compensate the Apple Inc. bond investors for the risk that Apple might not be able to pay back its debt obligations. The US Treasury Note Rate is considered the "risk free rate": O True False D | Question 13 2 pts Maturity risk premium compensates bond investors for: O greater interest rate risk associated with a longer maturity O risk of inflation the credit risk of the borrower the lack of liquidity (eg.. # of buyers and sellers is limited)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts