Question: D Question 11 What is Fitcom's current ratio [Select] [Select] Screen Shot 2017-08-17 at 10.37.43 AM.png and quick ratio 1 pts D Question 12 1

![D Question 11 What is Fitcom's current ratio [Select] [Select] Screen](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f8fb6a2aec0_32166f8fb69d6b04.jpg)

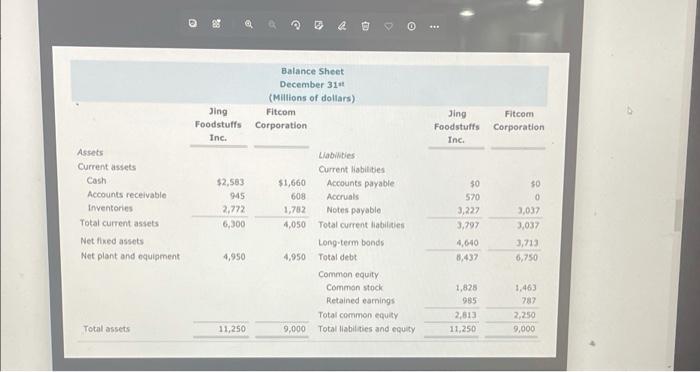

D Question 11 What is Fitcom's current ratio [Select] [Select] Screen Shot 2017-08-17 at 10.37.43 AM.png and quick ratio 1 pts D Question 12 1 pts Which of the following statements is true regarding the Balance Sheets below? 1. Fitcom Corp has less liquidity but also a greater reliance on outsider cash flow to finance its short- term obligations than Jing Foodstuffs. II. Fitcom Corp has a better ability to meet its short-term liabilities than Jing Foodstuffs Inc. III. Because Jing Foodstuffs Inc has a higher current ratio than Fitcom Corp, they must have a stronger liquidity position than Fitcom Corp. Screen Shot 2017-08-17 at 10.37.43 AM.png OL only O I. and II. O I, II, and II. Assets Current assets Cash Accounts receivable Inventories Total current assets Net fixed assets Net plant and equipment Total assets D% Jing Foodstuffs Inc. $2,583 945 2,772 6,300 4,950 11,250 E Balance Sheet December 31st (Millions of dollars). Fitcom Corporation Liabilities Current liabilities $1,660 Accounts payable 608 Accruals 1,782 Notes payable 4,050 Total current liabilities Long-term bonds 4,950 Total debt Common equity Common stock Retained earnings Total common equity 9,000 Total liabilities and equity Jing Fitcom Foodstuffs Corporation Inc. $0 50 570 3,227 3,797 4,640 8,437 1,828 985 2,813 11,250 0 3,037 3,037 3,713 6,750 1,463 787 2,250 9,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts