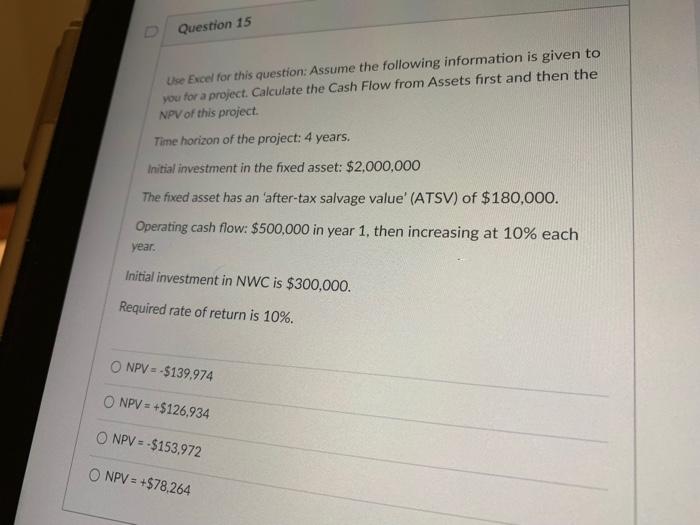

Question: D Question 15 Use Excel for this question: Assume the following information is given to you for a project. Calculate the Cash Flow from Assets

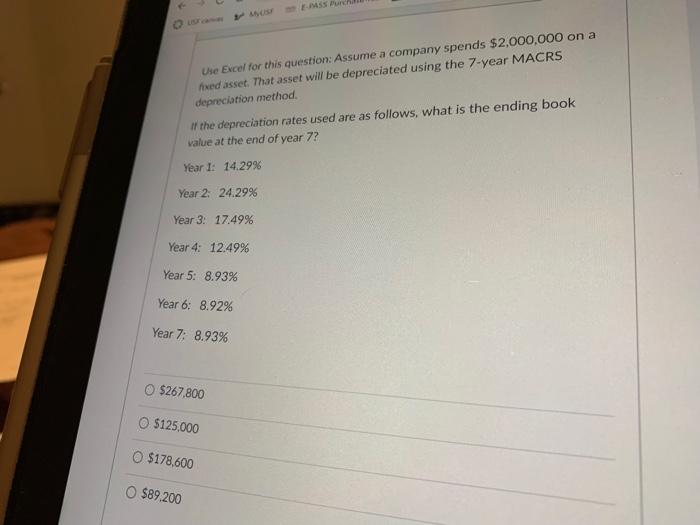

D Question 15 Use Excel for this question: Assume the following information is given to you for a project. Calculate the Cash Flow from Assets first and then the NPV of this project. Time horizon of the project: 4 years. Initial investment in the fixed asset: $2,000,000 The fixed asset has an 'after-tax salvage value' (ATSV) of $180,000. Operating cash flow: $500,000 in year 1, then increasing at 10% each year. Initial investment in NWC is $300,000. Required rate of return is 10%. NPV = $139.974 ONPV = +$126.934 O NPV = $153,972 NPV = +$78,264 M Punch Use Excel for this question: Assume a company spends $2,000,000 on a fixed asset. That asset will be depreciated using the 7-year MACRS depreciation method If the depreciation rates used are as follows, what is the ending book value at the end of year 7? Year 1: 14.2996 Year 2: 24.29% Year 3: 17.49% Year 4: 12.49% Year 5: 8.93% Year 6: 8.92% Year 7: 8.93% O $267,800 O $125,000 O $178,600 $89.200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts