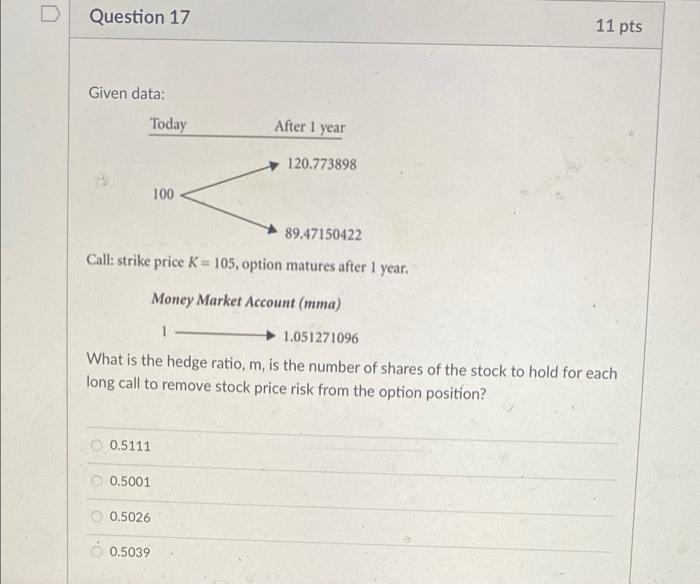

Question: D Question 17 11 pts Given data: Today After 1 year 120.773898 100 89.47150422 Call: strike price K = 105, option matures after 1 year.

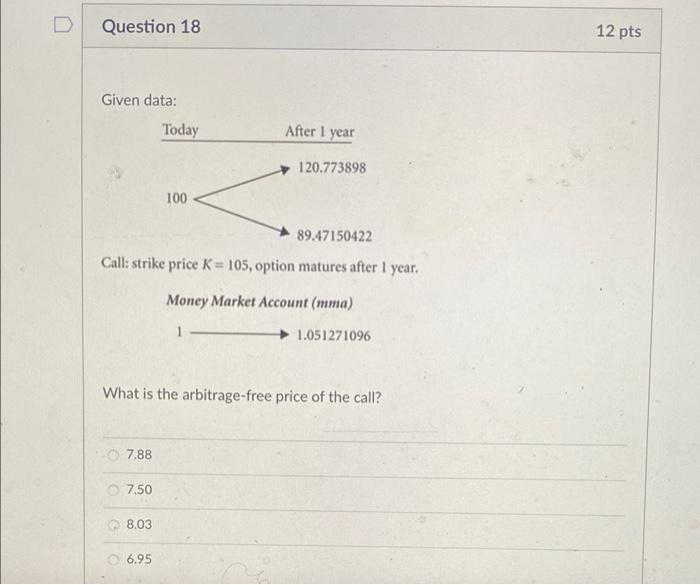

D Question 17 11 pts Given data: Today After 1 year 120.773898 100 89.47150422 Call: strike price K = 105, option matures after 1 year. Money Market Account (mma) 1.051271096 What is the hedge ratio, m, is the number of shares of the stock to hold for each long call to remove stock price risk from the option position? 0.5111 0,5001 0.5026 0.5039 Question 18 12 pts Given data: Today After 1 year 120.773898 100 89.47150422 Call: strike price K = 105, option matures after 1 year. Money Market Account (mma) 1.051271096 What is the arbitrage-free price of the call? 7.88 7.50 8.03 6.95 D Question 17 11 pts Given data: Today After 1 year 120.773898 100 89.47150422 Call: strike price K = 105, option matures after 1 year. Money Market Account (mma) 1.051271096 What is the hedge ratio, m, is the number of shares of the stock to hold for each long call to remove stock price risk from the option position? 0.5111 0,5001 0.5026 0.5039 Question 18 12 pts Given data: Today After 1 year 120.773898 100 89.47150422 Call: strike price K = 105, option matures after 1 year. Money Market Account (mma) 1.051271096 What is the arbitrage-free price of the call? 7.88 7.50 8.03 6.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts