Question: Consider the following data for computing option prices given to you by your professor. You want to know how this data was generated. The professor,

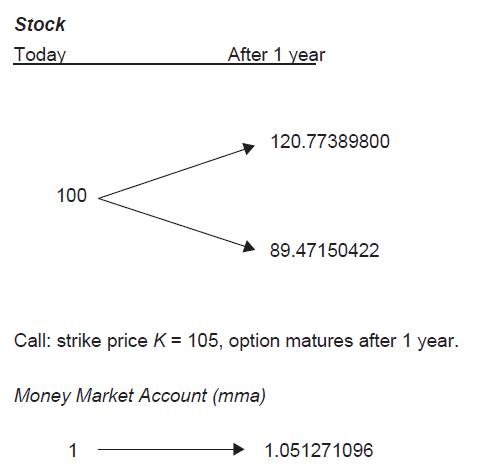

Consider the following data for computing option prices given to you by your professor.

You want to know how this data was generated. The professor, when asked, apologizes and says, “I used a Jarrow- Rudd approximation but I lost the data. You are an Excel expert— why don’t you use ‘Goal Seek’ and determine what the volatility is?”

Stock Today After 1 year 120.77389800 100 89.47150422 Call: strike price K105, option matures after 1 year. Money Market Account (mma) 1 1.051271096

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Type in the inputs of this binomial model in an Excel spreadsheet as follows where we have labeled the cells as in Excel for convenience Here we have ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

646-B-B-F-M (2882).docx

120 KBs Word File