Question: D Question 24 Consister a call option with an exercise price of $110 and one year to expiration. The underlying stock pays no dividends, its

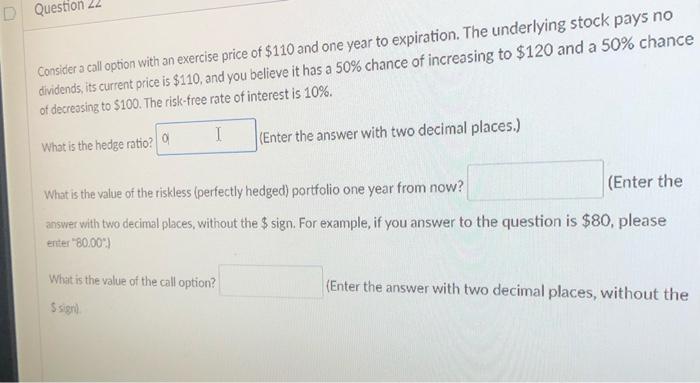

D Question 24 Consister a call option with an exercise price of $110 and one year to expiration. The underlying stock pays no dividends, its current price is $110, and you believe it has a 50% chance of increasing to $120 and a 50% chance of decreasing to $100. The risk-free rate of interest is 10%. 1 What is the hedge ratio? (Enter the answer with two decimal places.) What is the value of the riskless (perfectly hedged) portfolio one year from now? (Enter the answer with two decimal places, without the $ sign. For example, if you answer to the question is $80, please enter"80.00) What is the value of the call option? (Enter the answer with two decimal places, without the Sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts