Question: (a) Suppose a certain commodity is currently priced at $900 per pound in the spot market. Suppose the 1-year futures price is $950 per pound

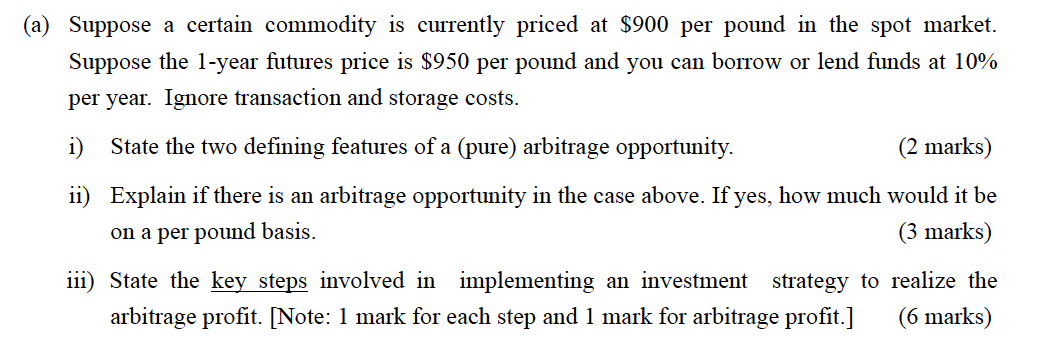

(a) Suppose a certain commodity is currently priced at $900 per pound in the spot market. Suppose the 1-year futures price is $950 per pound and you can borrow or lend funds at 10% per year. Ignore transaction and storage costs. i) State the two defining features of a (pure) arbitrage opportunity. (2 marks) ii) Explain if there is an arbitrage opportunity in the case above. If yes, how much would it be on a per pound basis. (3 marks) 111) State the key steps involved in implementing an investment strategy to realize the arbitrage profit. [Note: 1 mark for each step and 1 mark for arbitrage profit.] (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts