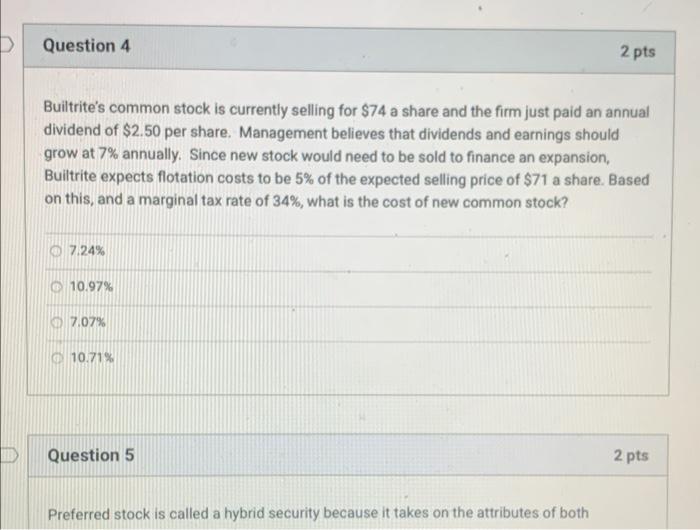

Question: D Question 4 2 pts Builtrite's common stock is currently selling for $74 a share and the firm just paid an annual dividend of $2.50

D Question 4 2 pts Builtrite's common stock is currently selling for $74 a share and the firm just paid an annual dividend of $2.50 per share. Management believes that dividends and earnings should grow at 7% annually. Since new stock would need to be sold to finance an expansion, Builtrite expects flotation costs to be 5% of the expected selling price of $71 a share. Based on this, and a marginal tax rate of 34%, what is the cost of new common stock? 7.24% @ 10.97% 07.07% 10.71% Question 5 2 pts Preferred stock is called a hybrid security because it takes on the attributes of both

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts