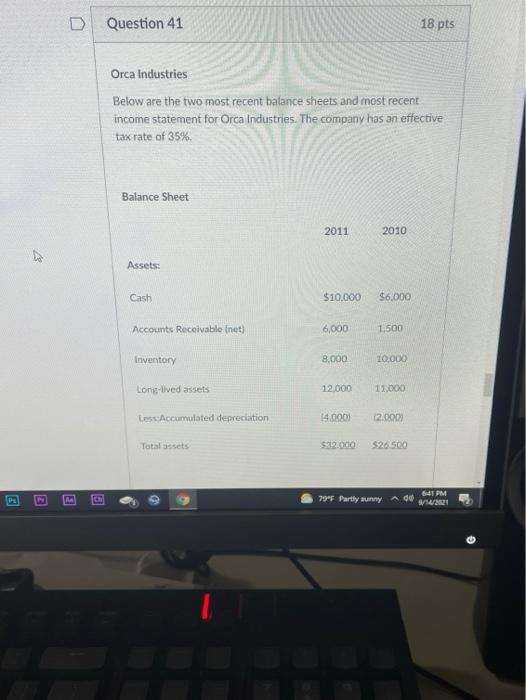

Question: D Question 41 18 pts Orca Industries Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company

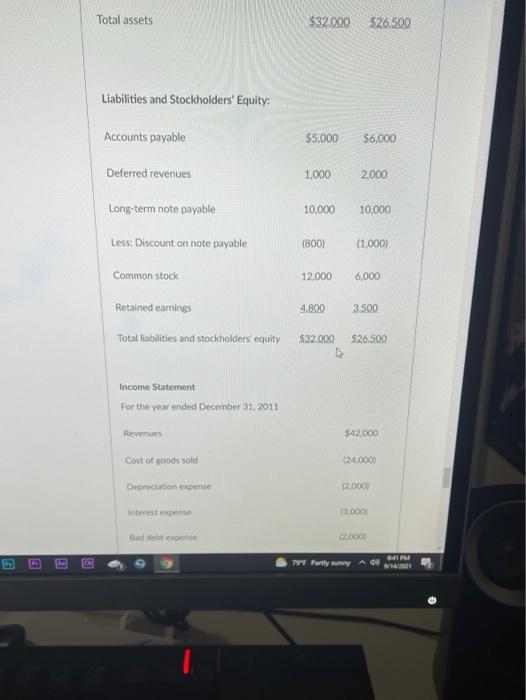

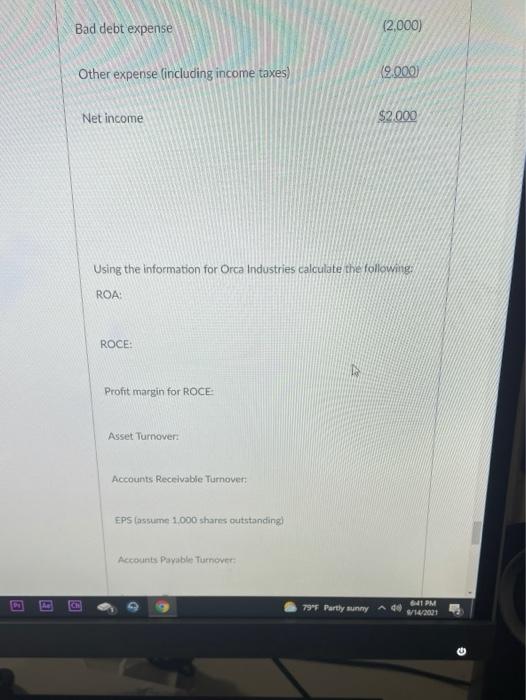

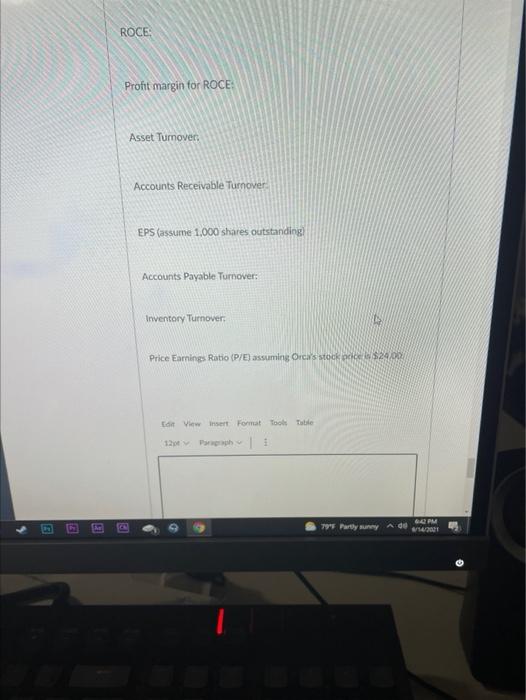

D Question 41 18 pts Orca Industries Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35% Balance Sheet 2011 2010 Assets: Cash $10.000 $6.000 Accounts Receivable (net) 6,000 1,500 Inventory 8.000 10,000 Long-lived assets 12.000 11.000 Less Accumulated depreciation 14.000 12.000 Total assets $32.000 $26.500 795 Partly sunny 641 PM A dd 14/2021 @ Total assets $32.000 $26.500 Liabilities and Stockholders' Equity: Accounts payable $5.000 $6,000 Deferred revenues 1.000 2.000 Long-term note payable 10,000 10.000 Less: Discount on note payable (800) (1.000) Common stock 12.000 6.000 Retained earnings 4.800 3.500 Total liabilities and stockholders equity $32,000 $26.500 Income Statement For the year ended December 31, 2011 Revenues $42.000 Cost of goods sold 124.000) Deprecation exente 120001 Interest Expense 3.000 Badden 12.000 PM D 7 Partly und Bad debt expense (2.000) Other expense (including income taxes) (2.000) Net income $2.000 Using the information for Orca Industries calculate the following ROA ROCE: Profit margin for ROCE Asset Turnover Accounts Receivable Turnover EPS (assume 1,000 shares outstanding Accounts Payabler Turnover CH 79F Partly GPM W14/2021 ROCE Profit margin for ROCE Asset Turnover, Accounts Receivable Turnover EPS (assume 1.000 shares outstanding Accounts Payable Turnover: Inventory Turnover Price Earnings Ratio (P/E) assuming Orca's stock de $29. View the Format Tools Title 120 | @ 0 G 9 GM 79 Peysunny A de /14/2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts