Question: Orca Industries Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate

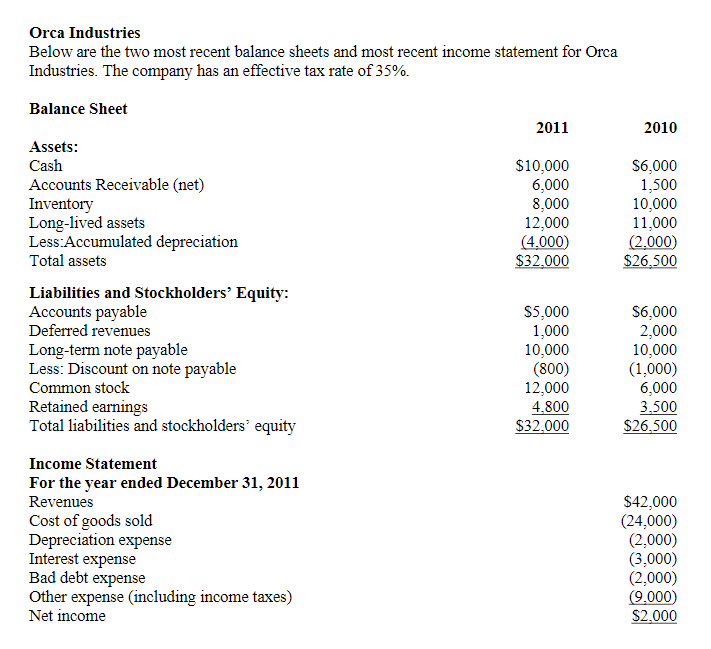

Orca Industries Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%. Balance Sheet 2011 2010 Assets: Cash Accounts Receivable (net) Inventory Long-lived assets Less:Accumulated depreciation Total assets $10,000 6,000 8,000 12,000 (4.000) $32.000 $6,000 1,500 10,000 11.000 (2.000) $26.500 Liabilities and Stockholders' Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock Retained earnings Total liabilities and stockholders' equity $5,000 1,000 10,000 (800) 12,000 4,800 $32.000 $6,000 2.000 10,000 (1,000) 6.000 3,500 $26.500 Income Statement For the year ended December 31, 2011 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net income $42,000 (24,000) (2.000) (3.000) (2.000) (9.000) $2.000 Using the information for Orca Industries calculate the following: Show your work. ROA: ROCE: Profit Margin for ROCE: Asset Turnover: Accounts Receivable Turnover: EPS (assuming 1,000 shares outstanding): Accounts Payable Turnover: Inventory Turnover: Price Earnings Ratio (P/E) assuming the stock price is $24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts