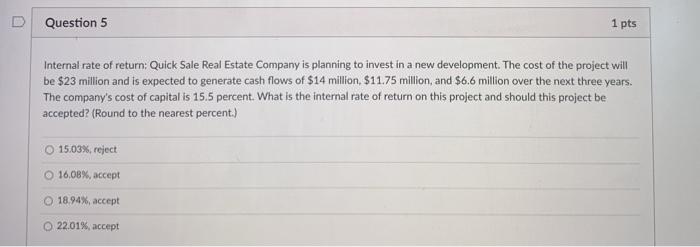

Question: D Question 5 1 pts Internal rate of return: Quick Sale Real Estate Company is planning to invest in a new development. The cost of

D Question 5 1 pts Internal rate of return: Quick Sale Real Estate Company is planning to invest in a new development. The cost of the project will be $23 million and is expected to generate cash flows of $14 million, $11.75 million, and $6.6 million over the next three years. The company's cost of capital is 15.5 percent. What is the internal rate of return on this project and should this project be accepted? (Round to the nearest percent.) 15.03%,reject 16.08%, accept 18.94%, accept O 22.01%, accept

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock