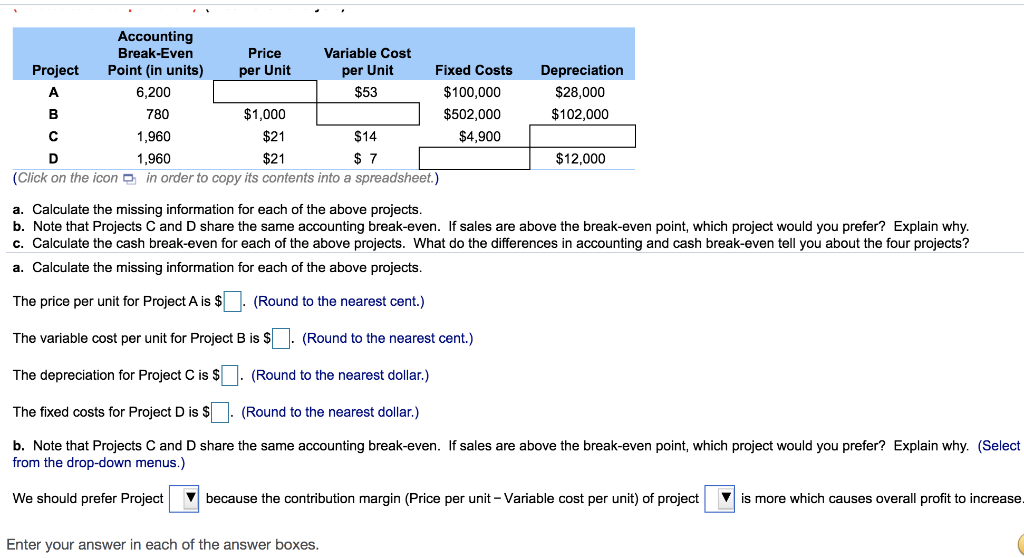

Question: per Unit Accounting Break-Even Price Variable Cost Project Point (in units) per Unit Fixed Costs A 6,200 $53 $100,000 B 780 $1,000 $502,000 C 1,960

per Unit Accounting Break-Even Price Variable Cost Project Point (in units) per Unit Fixed Costs A 6,200 $53 $100,000 B 780 $1,000 $502,000 C 1,960 $21 $14 $4,900 D 1,960 $21 $ 7 (Click on the icon in order to copy its contents into a spreadsheet.) Depreciation $28,000 $102,000 $12.000 a. Calculate the missing information for each of the above projects. b. Note that Projects C and D share the same accounting break-even. If sales are above the break-even point, which project would you prefer? Explain why. c. Calculate the cash break-even for each of the above projects. What do the differences in accounting and cash break-even tell you about the four projects? a. Calculate the missing information for each of the above projects. The price per unit for Project A is $ (Round to the nearest cent.) The variable cost per unit for Project B is $ (Round to the nearest cent.) The depreciation for Project C is $ (Round to the nearest dollar.) The fixed costs for Project D is $ (Round to the nearest dollar.) b. Note that Projects C and D share the same accounting break-even. If sales are above the break-even point, which project would you prefer? Explain why. (Select the drop-down menus.) We should prefer Project because the contribution margin (Price per unit - Variable cost per unit) of project V is more which causes overall profit to increase Enter your answer in each of the answer boxes. per Unit Accounting Break-Even Price Variable Cost Project Point (in units) per Unit Fixed Costs A 6,200 $53 $100,000 B 780 $1,000 $502,000 C 1,960 $21 $14 $4,900 D 1,960 $21 $ 7 (Click on the icon in order to copy its contents into a spreadsheet.) Depreciation $28,000 $102,000 $12.000 a. Calculate the missing information for each of the above projects. b. Note that Projects C and D share the same accounting break-even. If sales are above the break-even point, which project would you prefer? Explain why. c. Calculate the cash break-even for each of the above projects. What do the differences in accounting and cash break-even tell you about the four projects? a. Calculate the missing information for each of the above projects. The price per unit for Project A is $ (Round to the nearest cent.) The variable cost per unit for Project B is $ (Round to the nearest cent.) The depreciation for Project C is $ (Round to the nearest dollar.) The fixed costs for Project D is $ (Round to the nearest dollar.) b. Note that Projects C and D share the same accounting break-even. If sales are above the break-even point, which project would you prefer? Explain why. (Select the drop-down menus.) We should prefer Project because the contribution margin (Price per unit - Variable cost per unit) of project V is more which causes overall profit to increase Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts