Question: D Question 7 15 pts Problems: Show all the work clearly, for partial or full credit. Excel file should exhibit formulas. Calculate all rates to

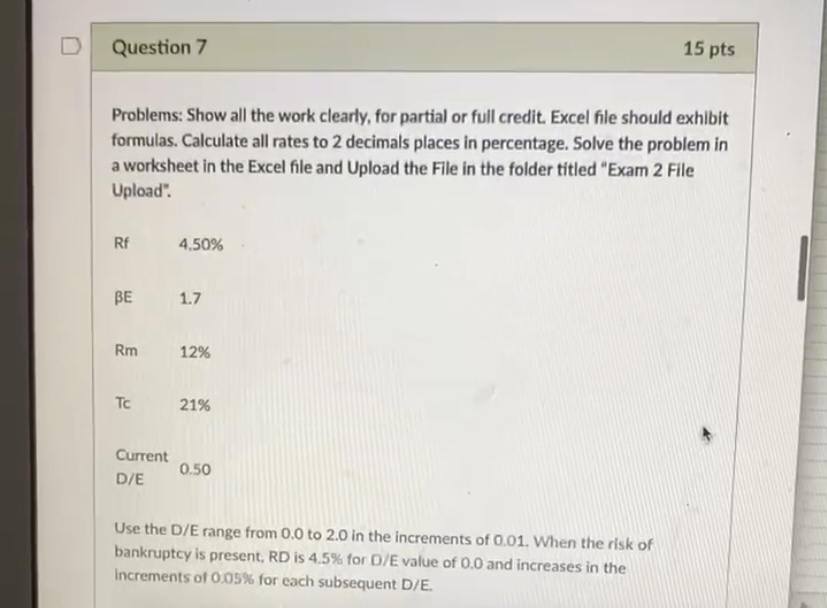

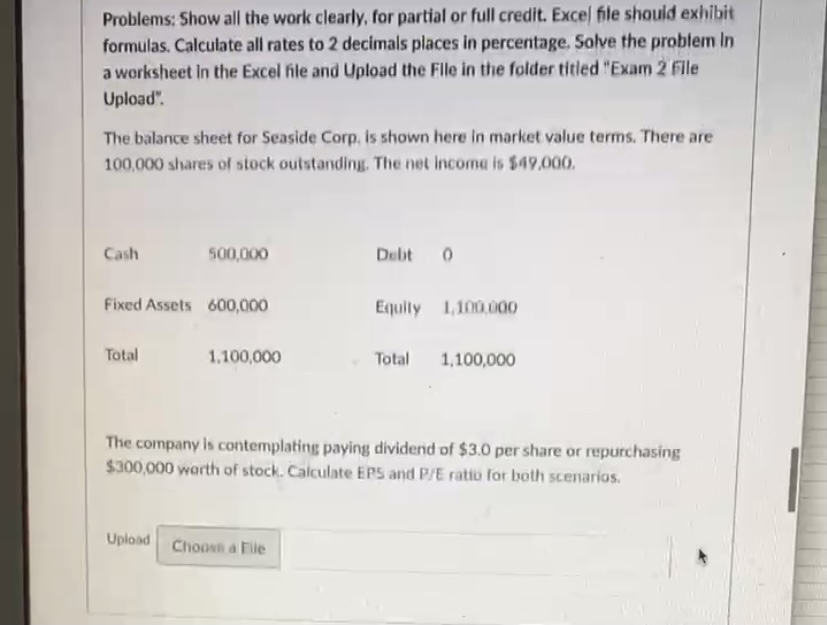

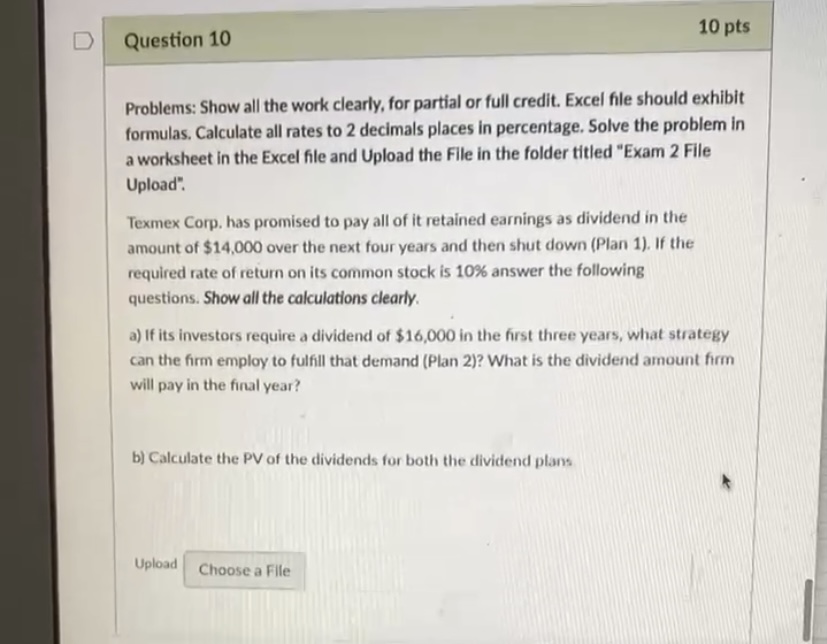

D Question 7 15 pts Problems: Show all the work clearly, for partial or full credit. Excel file should exhibit formulas. Calculate all rates to 2 decimals places in percentage. Solve the problem in a worksheet in the Excel file and Upload the File in the folder titled "Exam 2 File Upload". Rf 4.50% BE 1.7 Rm 12% TC 21% Current 0.50 D/E Use the D/E range from 0.0 to 2.0 in the increments of 0.01. When the risk of bankruptcy is present, RD is 4.5% for D/E value of 0.0 and increases in the Increments of 0.05% for each subsequent D/E.Problems: Show all the work clearly, for partial or full credit. Excel file should exhibit formulas. Calculate all rates to 2 decimals places in percentage, Solve the problem In a worksheet in the Excel file and Upload the File in the folder titled "Exam 2 File Upload". The balance sheet for Seaside Corp, is shown here In market value terms. There are 100,000 shares of stock outstanding. The net Income is $49,000. Cash 500,000 Debt 0 Fixed Assets 600,000 Equity 1,100,000 Total 1,100,000 Total 1,100,000 The company is contemplating paying dividend of $3.0 per share or repurchasing $300;000 worth of stock. Calculate EPS and P/E ratio for both scenarios. Upload Choose a FileD Question 10 10 pts Problems: Show all the work clearly, for partial or full credit. Excel file should exhibit formulas. Calculate all rates to 2 decimals places in percentage. Solve the problem in a worksheet in the Excel file and Upload the File in the folder titled "Exam 2 File Upload". Texmex Corp. has promised to pay all of it retained earnings as dividend in the amount of $14,000 over the next four years and then shut down (Plan 1). If the required rate of return on its common stock is 10% answer the following questions. Show all the calculations clearly. a) If its investors require a dividend of $16,000 in the first three years, what strategy can the firm employ to fulfill that demand (Plan 2)? What is the dividend amount firm will pay in the final year? b) Calculate the PV of the dividends for both the dividend plans Upload Choose a File