Question: d. What is the correct excel formula for this problem to yield your results? (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) The 11-year

d. What is the correct excel formula for this problem to yield your results?

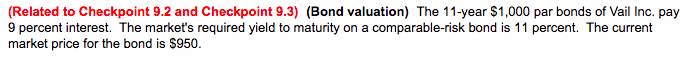

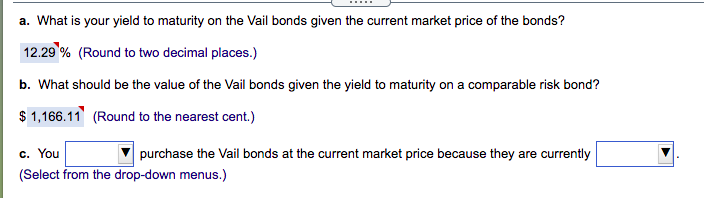

(Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) The 11-year $1,000 par bonds of Vail Inc. pay 9 percent interest. The market's required yield to maturity on a comparable-risk bond is 11 percent. The current market price for the bond is $950. a. What is your yield to maturity on the Vail bonds given the current market price of the bonds? 12.29% (Round to two decimal places.) b. What should be the value of the Vail bonds given the yield to maturity on a comparable risk bond? $ 1,166.11 (Round to the nearest cent.) c. You purchase the Vail bonds at the current market price because they are currently (Select from the drop-down menus.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts