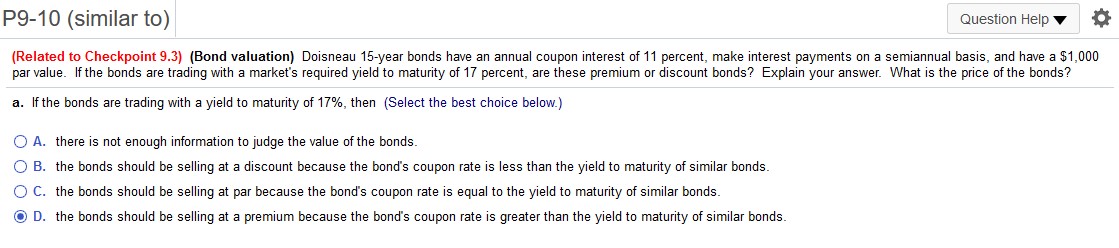

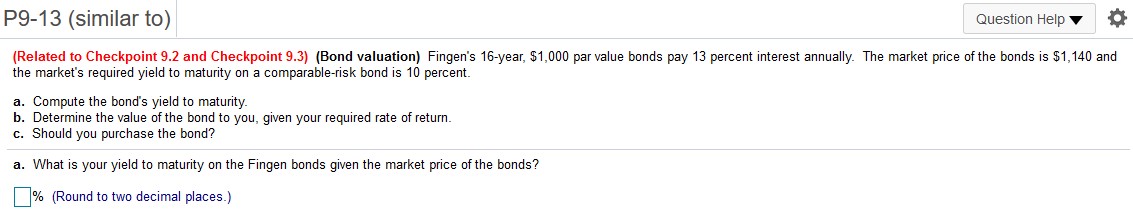

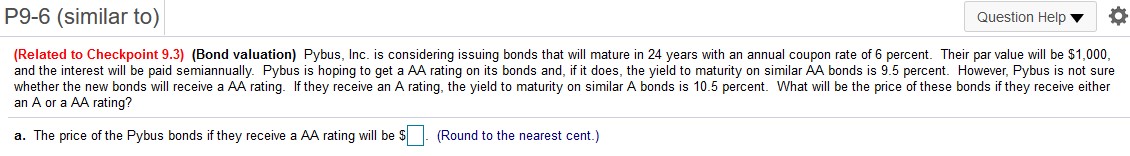

Question: Each Problem Has Multiple Questions///// P9-10 (similar 120) Question HelpV it} {Related to Checkpoint 9.3} {Bond valuation} Doisneau 15year bonds have an annual coupon interest

\\\\\Each Problem Has Multiple Questions/////

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock