Question: D. X1 = 20%, X2 = 80% E. X1 = 10%, X2 = 90% 14. A bank's balance sheet has $100 million in cash and

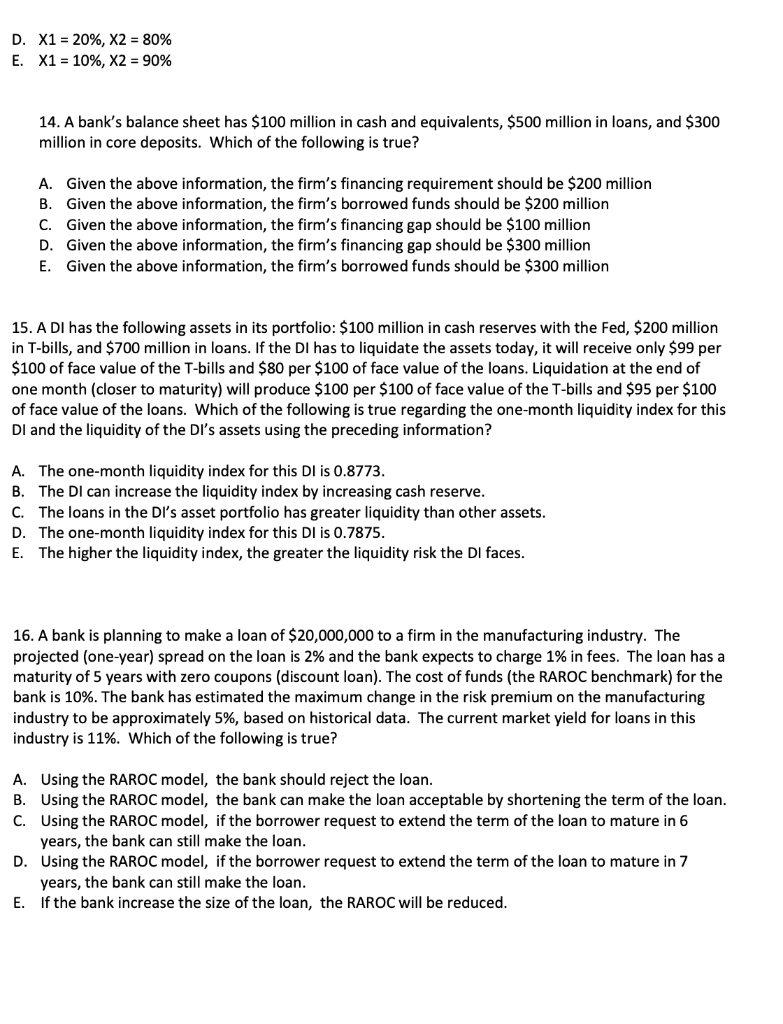

D. X1 = 20%, X2 = 80% E. X1 = 10%, X2 = 90% 14. A bank's balance sheet has $100 million in cash and equivalents, $500 million in loans, and $300 million in core deposits. Which of the following is true? A. Given the above information, the firm's financing requirement should be $200 million B. Given the above information, the firm's borrowed funds should be $200 million C. Given the above information, the firm's financing gap should be $100 million D. Given the above information, the firm's financing gap should be $300 million E. Given the above information, the firm's borrowed funds should be $300 million 15. A DI has the following assets in its portfolio: $100 million in cash reserves with the Fed, $200 million in T-bills, and $700 million in loans. If the DI has to liquidate the assets today, it will receive only $99 per $100 of face value of the T-bills and $80 per $100 of face value of the loans. Liquidation at the end of one month (closer to maturity) will produce $100 per $100 of face value of the T-bills and $95 per $100 of face value of the loans. Which of the following is true regarding the one-month liquidity index for this DI and the liquidity of the DI's assets using the preceding information? A. The one-month liquidity index for this DI is 0.8773. B. The DI can increase the liquidity index by increasing cash reserve. C. The loans in the DI's asset portfolio has greater liquidity than other assets. D. The one-month liquidity index for this DI is 0.7875. E. The higher the liquidity index, the greater the liquidity risk the DI faces. 16. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 2% and the bank expects to charge 1% in fees. The loan has a maturity of 5 years with zero coupons (discount loan). The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yield for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should reject the loan. B. Using the RAROC model, the bank can make the loan acceptable by shortening the term of the loan. C. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 6 years, the bank can still make the loan. D. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 7 years, the bank can still make the loan. E. If the bank increase the size of the loan, the RAROC will be reduced. D. X1 = 20%, X2 = 80% E. X1 = 10%, X2 = 90% 14. A bank's balance sheet has $100 million in cash and equivalents, $500 million in loans, and $300 million in core deposits. Which of the following is true? A. Given the above information, the firm's financing requirement should be $200 million B. Given the above information, the firm's borrowed funds should be $200 million C. Given the above information, the firm's financing gap should be $100 million D. Given the above information, the firm's financing gap should be $300 million E. Given the above information, the firm's borrowed funds should be $300 million 15. A DI has the following assets in its portfolio: $100 million in cash reserves with the Fed, $200 million in T-bills, and $700 million in loans. If the DI has to liquidate the assets today, it will receive only $99 per $100 of face value of the T-bills and $80 per $100 of face value of the loans. Liquidation at the end of one month (closer to maturity) will produce $100 per $100 of face value of the T-bills and $95 per $100 of face value of the loans. Which of the following is true regarding the one-month liquidity index for this DI and the liquidity of the DI's assets using the preceding information? A. The one-month liquidity index for this DI is 0.8773. B. The DI can increase the liquidity index by increasing cash reserve. C. The loans in the DI's asset portfolio has greater liquidity than other assets. D. The one-month liquidity index for this DI is 0.7875. E. The higher the liquidity index, the greater the liquidity risk the DI faces. 16. A bank is planning to make a loan of $20,000,000 to a firm in the manufacturing industry. The projected (one-year) spread on the loan is 2% and the bank expects to charge 1% in fees. The loan has a maturity of 5 years with zero coupons (discount loan). The cost of funds (the RAROC benchmark) for the bank is 10%. The bank has estimated the maximum change in the risk premium on the manufacturing industry to be approximately 5%, based on historical data. The current market yield for loans in this industry is 11%. Which of the following is true? A. Using the RAROC model, the bank should reject the loan. B. Using the RAROC model, the bank can make the loan acceptable by shortening the term of the loan. C. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 6 years, the bank can still make the loan. D. Using the RAROC model, if the borrower request to extend the term of the loan to mature in 7 years, the bank can still make the loan. E. If the bank increase the size of the loan, the RAROC will be reduced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts