Question: (D2) 3rd time posting. please help me answer this question correctly. Discussion Initial Response Due by Wednesday: It is payday! You look at your pay

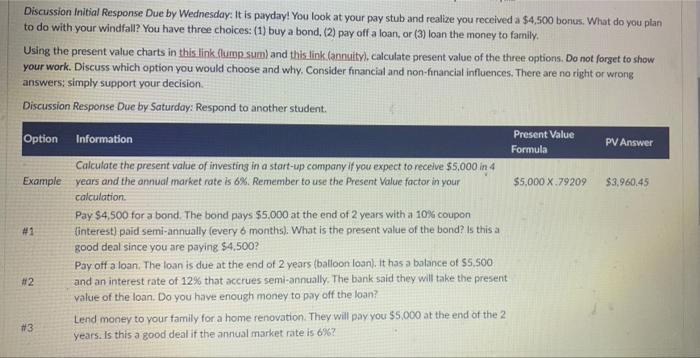

Discussion Initial Response Due by Wednesday: It is payday! You look at your pay stub and realize you received a $4,500 bonus. What do you plan to do with your windfall? You have three choices: (1) buy a bond, (2) pay off a loan, or (3) loan the money to family. Using the present value charts in this link (lump sum) and this link (annuity), calculate present value of the three options. Do not forget to show your work. Discuss which option you would choose and why. Consider financial and non-financial influences. There are no right or wrong answers: simply support your decision. Discussion Response Due by Saturday: Respond to another student. Option Information Present Value Formula PV Answer Calculate the present value of investing in a start-up company if you expect to receive $5,000 in 4 Example years and the annual market rate is 6%. Remember to use the Present Value factor in your calculation. $5,000 X.79209 $3,960.45 #1 Pay $4,500 for a bond. The bond pays $5,000 at the end of 2 years with a 10% coupon (interest) paid semi-annually (every 6 months). What is the present value of the bond? Is this a good deal since you are paying $4,500? #2 Pay off a loan. The loan is due at the end of 2 years (balloon loan). It has a balance of $5,500 and an interest rate of 12% that accrues semi-annually. The bank said they will take the present value of the loan. Do you have enough money to pay off the loan? # 3 Lend money to your family for a home renovation. They will pay you $5,000 at the end of the 2 years. Is this a good deal if the annual market rate is 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts