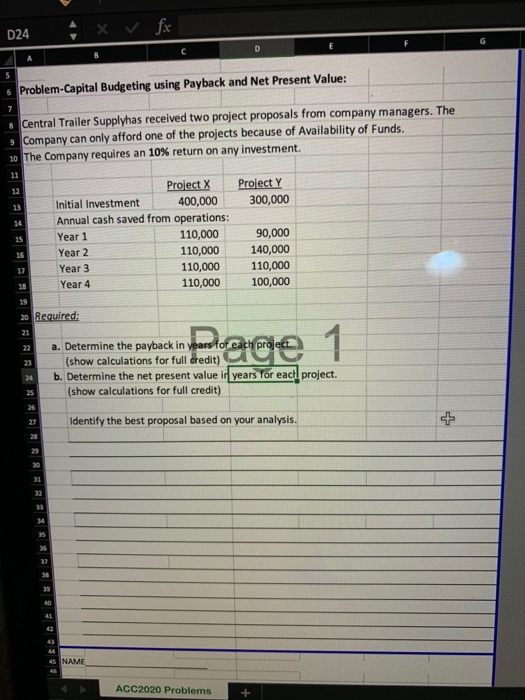

Question: D24 X fx Problem-Capital Budgeting using Payback and Net Present Value: Central Trailer Supplyhas received two project proposals from company managers. The Company can only

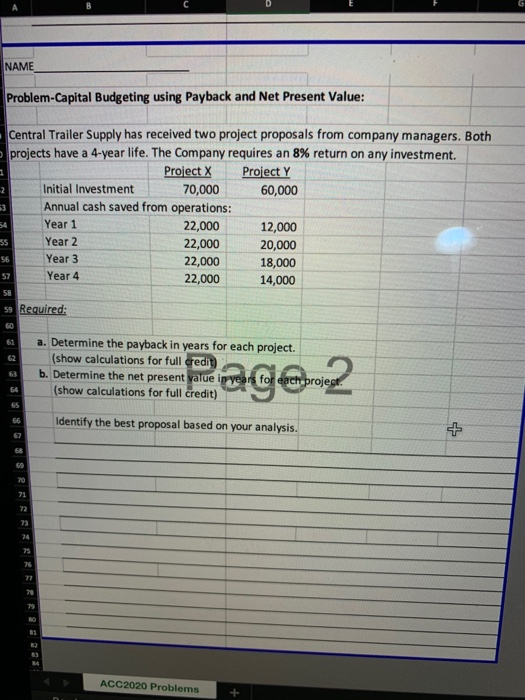

D24 X fx Problem-Capital Budgeting using Payback and Net Present Value: Central Trailer Supplyhas received two project proposals from company managers. The Company can only afford one of the projects because of Availability of Funds. 30 The Company requires an 10% return on any investment. Project Y 300,000 Project X Initial Investment 400,000 Annual cash saved from operations: Year 1 110,000 Year 2 110,000 Year 3 110,000 Year 4 110,000 90,000 140,000 110,000 100,000 20 Required: 22 a. Determine the payback in years for each project. (show calculations for full credit) b. Determine the net present value in years for each project. (show calculations for full credit) Identify the best proposal based on your analysis. NAME ACC2020 Problems AME Problem-Capital Budgeting using Payback and Net Present Value: Central Trailer Supply has received two project proposals from company managers. Both projects have a 4-year life. The Company requires an 8% return on any investment. Project X Project Y Initial Investment 70,000 60,000 Annual cash saved from operations: Year 1 22,000 12,000 Year 2 22,000 20,000 Year 3 22,000 18,000 Year 4 22,000 14,000 5 Required: a. Determine the payback in years for each project. (show calculations for full credit b. Determine the net present yalue in years for each project. (show calculations for full credit) Identify the best proposal based on your analysis. ACC2020 Problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts