Question: D.A-Aa- Styles A a 8 Editing Dictate 2 T Font Paragraph 5 Styles Voice One of your clients has a portfolio equal to $60,000 and

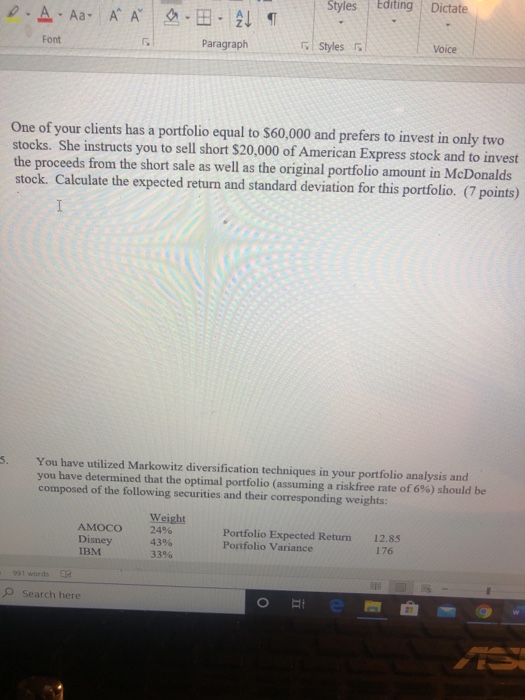

D.A-Aa- Styles A a 8 Editing Dictate 2 T Font Paragraph 5 Styles Voice One of your clients has a portfolio equal to $60,000 and prefers to invest in only two stocks. She instructs you to sell short $20,000 of American Express stock and to invest the proceeds from the short sale as well as the original portfolio amount in McDonalds stock. Calculate the expected return and standard deviation for this portfolio. (7 points) You have utilized Markowitz diversification techniques in your portfolio analysis and you have determined that the optimal portfolio (assuming a riskfree rate of 696) should be composed of the following securities and their corresponding weights: AMOCO Disney IBM Weight 24% 43% 33% Portfolio Expected Return Portfolio Variance 12.85 176 991 words OR Search here D.A-Aa- Styles A a 8 Editing Dictate 2 T Font Paragraph 5 Styles Voice One of your clients has a portfolio equal to $60,000 and prefers to invest in only two stocks. She instructs you to sell short $20,000 of American Express stock and to invest the proceeds from the short sale as well as the original portfolio amount in McDonalds stock. Calculate the expected return and standard deviation for this portfolio. (7 points) You have utilized Markowitz diversification techniques in your portfolio analysis and you have determined that the optimal portfolio (assuming a riskfree rate of 696) should be composed of the following securities and their corresponding weights: AMOCO Disney IBM Weight 24% 43% 33% Portfolio Expected Return Portfolio Variance 12.85 176 991 words OR Search here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts