Question: Daisy Security Products is considering a project which will require the investment of R1.4 million in new equipment. The equipment will be depreciated straight-line to

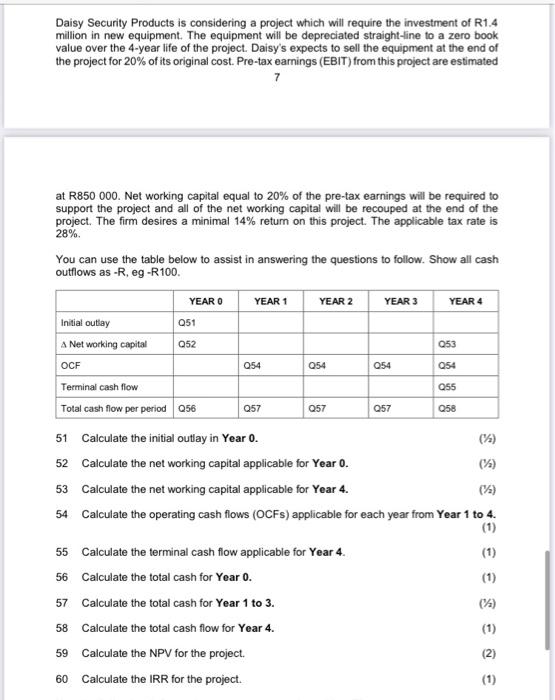

Daisy Security Products is considering a project which will require the investment of R1.4 million in new equipment. The equipment will be depreciated straight-line to a zero book value over the 4-year life of the project. Daisy's expects to sell the equipment at the end of the project for 20% of its original cost. Pre-tax earnings (EBIT) from this project are estimated 7 at R850 000. Net working capital equal to 20% of the pre-tax earnings will be required to support the project and all of the networking capital will be recouped at the end of the project. The firm desires a minimal 14% return on this project. The applicable tax rate is 28% You can use the table below to assist in answering the questions to follow. Show all cash outflows as-R, eg -R100. YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 051 Initial outlay A Networking capital A Q52 053 OCF 054 054 054 054 055 Terminal cash flow Total cash flow per period 056 Q57 Q57 Q57 Q58 51 Calculate the initial outlay in Year 0. (%) 52 Calculate the net working capital applicable for Year 0. (% 53 Calculate the net working capital applicable for Year 4. (1) 54 Calculate the operating cash flows (OCF) applicable for each year from Year 1 to 4. (1) (4) 55 Calculate the terminal cash flow applicable for Year 4. 56 Calculate the total cash for Year 0. 57 Calculate the total cash for Year 1 to 3. 58 Calculate the total cash flow for Year 4. Calculate the NPV for the project. 60 Calculate the IRR for the project. (1) 59 (2) (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts