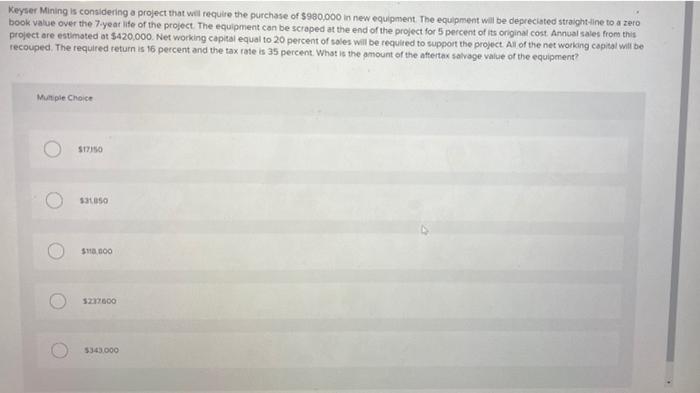

Question: Keyser Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment will be depreciated straight-line to a zero

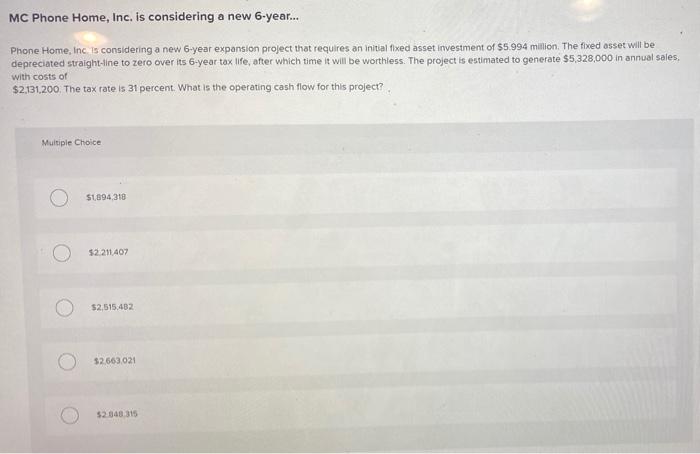

Keyser Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment will be depreciated straight-line to a zero book value over the 7-year life of the project. The equipment can be scraped at the end of the project for 5 percent of its original cost Annual sales from this project are estimated at $420,000. Net working capital equal to 20 percent of sales will be required to support the project All of the networking capital will be recouped. The required return is 16 percent and the tax rate is 35 percent. What is the amount of the aftertax savage value of the equipment? Murple Choice SITIO SOSO $110 5237600 5343.000 MC Phone Home, Inc. is considering a new 6-year... Phone Home, Inc is considering a new 6-year expansion project that requires an initial fixed asset investment of $5.994 million. The fixed asset will be depreciated straight-line to zero over its 6-year tax life, after which time it will be worthless. The project is estimated to generate $5,328,000 in annual sales, with costs of $2.131.200 The tax rate is 31 percent. What is the operating cash flow for this project? Multiple Choice S1894,318 $2.211.407 $2,515.482 $2663021 52.48.315

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts