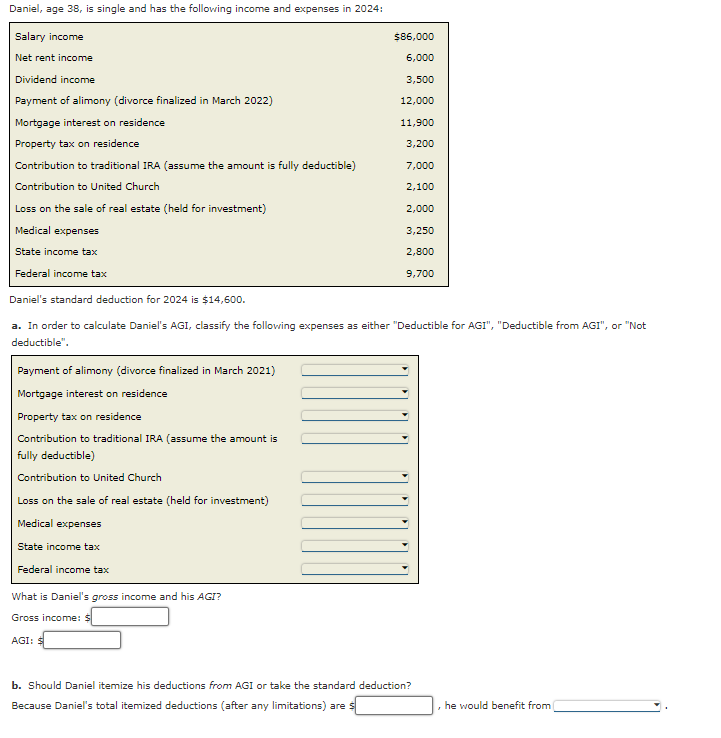

Question: Daniel, age 3 8 , is single and has the following income and expenses in 2 0 2 4 : Daniel's standard deduction for 2

Daniel, age is single and has the following income and expenses in :

Daniel's standard deduction for is $

a In order to calculate Daniel's AGI, classify the following expenses as either "Deductible for AGI", "Deductible from AGI", or "Not deductible".

Payment of alimony divorce finalized in March

Mortgage interest on residence

Property tax on residence

Contribution to traditional IRA assume the amount is fully deductible

Contribution to United Church

Loss on the sale of real estate held for investment

Medical expenses

State income tax

Federal income tax

What is Daniel's gross income and his A G I

Gross income: $

AGI: leftrightarrows

b Should Daniel itemize his deductions from AGI or take the standard deduction?

Because Daniel's total itemized deductions after any limitations are leq he would benefit from

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock