Question: Dark Sky Manufacturing (DSM) installed a computerized machine in its factory at a cost of $400,000 on July 1, 2023. The machine has an

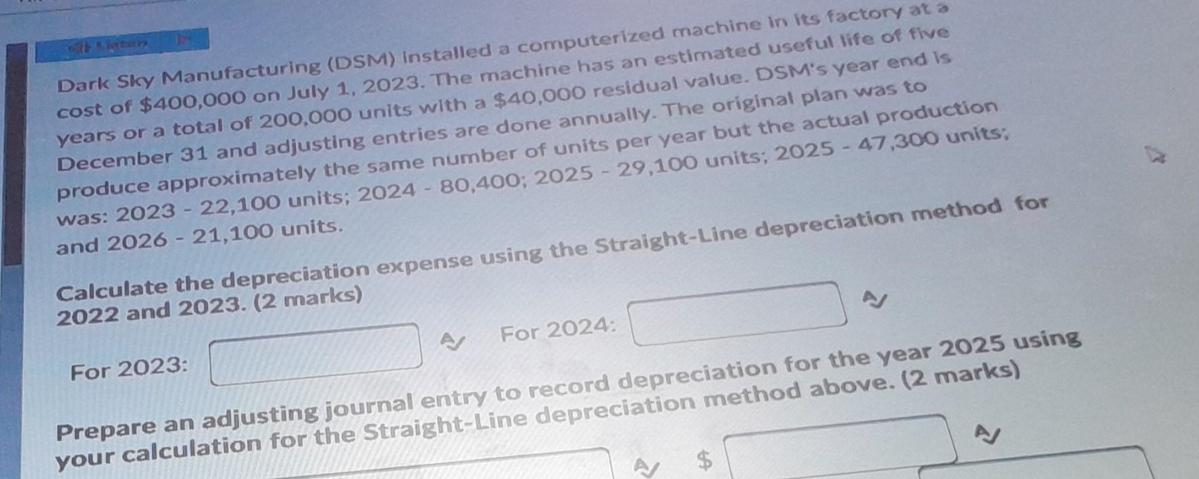

Dark Sky Manufacturing (DSM) installed a computerized machine in its factory at a cost of $400,000 on July 1, 2023. The machine has an estimated useful life of five years or a total of 200,000 units with a $40,000 residual value. DSM's year end is December 31 and adjusting entries are done annually. The original plan was to produce approximately the same number of units per year but the actual production was: 2023 - 22,100 units; 2024 - 80,400; 2025 - 29,100 units; 2025-47,300 units; and 2026 - 21,100 units. Calculate the depreciation expense using the Straight-Line depreciation method for 2022 and 2023. (2 marks) For 2023: For 2024: N Prepare an adjusting journal entry to record depreciation for the year 2025 using your calculation for the Straight-Line depreciation method above. (2 marks) $

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts