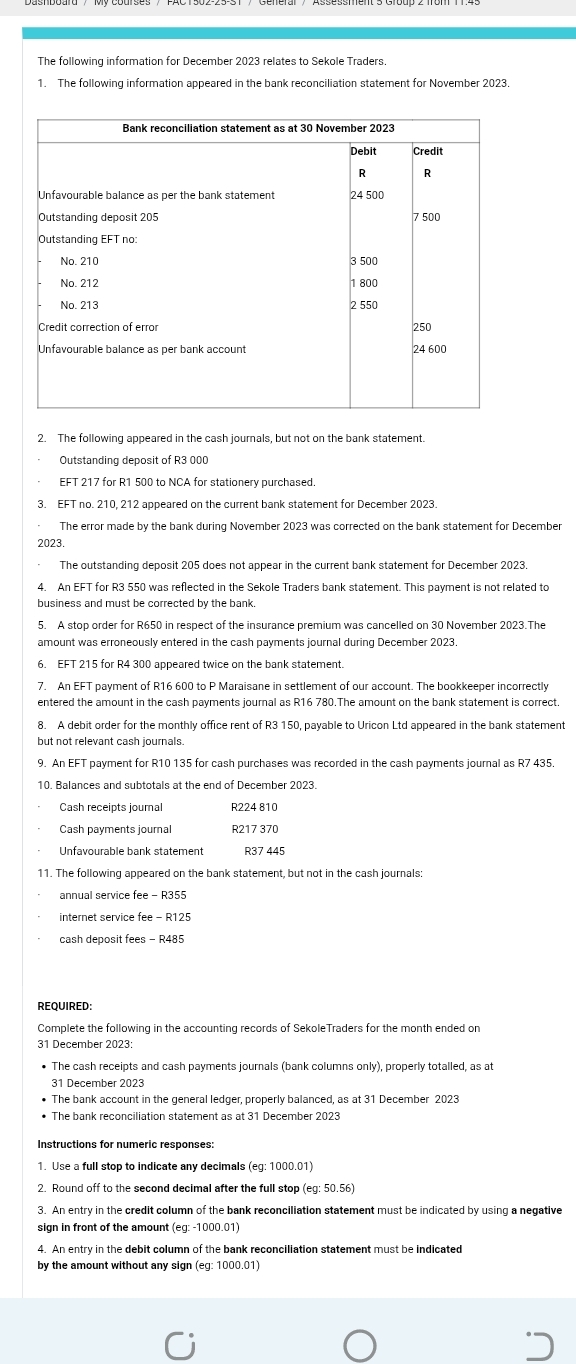

Question: DasibOdiThe following information for December 2 0 2 3 relates to Sekole Traders . 1 . The following information appeared in the bank reconciliation statement

DasibOdiThe following information for December relates to Sekole Traders The following information appeared in the bank reconciliation statement for November Unfavourable balance as per the bank statementOutstanding deposit Outstanding EFT no:NoBank reconciliation statement as at November NoNoCredit correction of errorUnfavourable balance as per bank accountEFT for R to NCA for stationery purchased The following appeared in the cash journals, but not on the bank statement.Outstanding deposit of R EFT for R appeared twice on the bank statement.EFT no appeared on the current bank statement for December Cash receipts joumalThe error made by the bank during November was corrected on the bank statement for DecemberCash payments journalUnfavourable bank statementThe outstanding deposit does not appear in the current bank statement for December An EFT for R was reflected in the Sekole Traders bank statement. This payment is not related tobusiness and must be corrected by the bank.annual service fee R A stop order for R in respect of the insurance premium was cancelled on November Theamount was erroneously entered in the cash payments journal during December internet service fee RDebitcash deposit fees RREQUIRED: An EFT payment of R to P Maraisane in settlement of our account. The bookkeeper incorrectlyentered the amount in the cash payments journal as RThe amount on the bank statement is correct A debit order for the monthly office rent of R payable to Uricon Ltd appeared in the bank statementbut not relevant cash journals.R An EFT payment for R for cash purchases was recorded in the cash payments journal as R Balances and subtotals at the end of December RRRInstructions for numeric responses:CreditRThe bank reconciliation statement as at December The following appeared on the bank statement, but not in the cash journals: Use a full stop to indicate any decimals eg: Complete the following in the accounting records of SekoleTraders for the month ended on December :by the amount without any sign eg: The cash receipts and cash payments journals bank columns only properly totalled, as at December Round off to the second decimal after the full stop eg: The bank account in the general ledger, properly balanced, as at December An entry in the credit column of the bank reconciliation statement must be indicated by using a negativesign in front of the amount eg: An entry in the debit column of the bank reconcilation statement must be indicated

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock