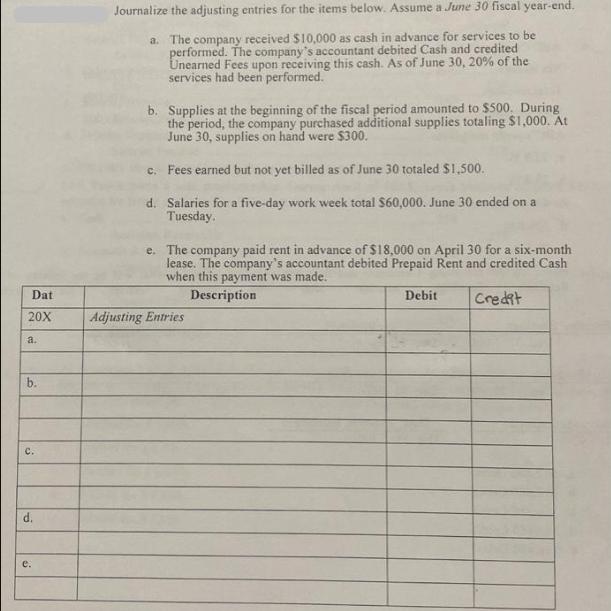

Question: Dat 20X a. b. C. d. e. Journalize the adjusting entries for the items below. Assume a June 30 fiscal year-end. a. The company

Dat 20X a. b. C. d. e. Journalize the adjusting entries for the items below. Assume a June 30 fiscal year-end. a. The company received $10,000 as cash in advance for services to be performed. The company's accountant debited Cash and credited Unearned Fees upon receiving this cash. As of June 30, 20% of the services had been performed. b. Supplies at the beginning of the fiscal period amounted to $500. During the period, the company purchased additional supplies totaling $1,000. At June 30, supplies on hand were $300. c. Fees earned but not yet billed as of June 30 totaled $1,500. d. Salaries for a five-day work week total $60,000. June 30 ended on a Tuesday. e. The company paid rent in advance of $18,000 on April 30 for a six-month lease. The company's accountant debited Prepaid Rent and credited Cash when this payment was made. Description Credit Adjusting Entries Debit

Step by Step Solution

3.65 Rating (163 Votes )

There are 3 Steps involved in it

a Adjusting entry for recognizing the services performed Debit Unearned Fees 2000 Credit Fees Ea... View full answer

Get step-by-step solutions from verified subject matter experts