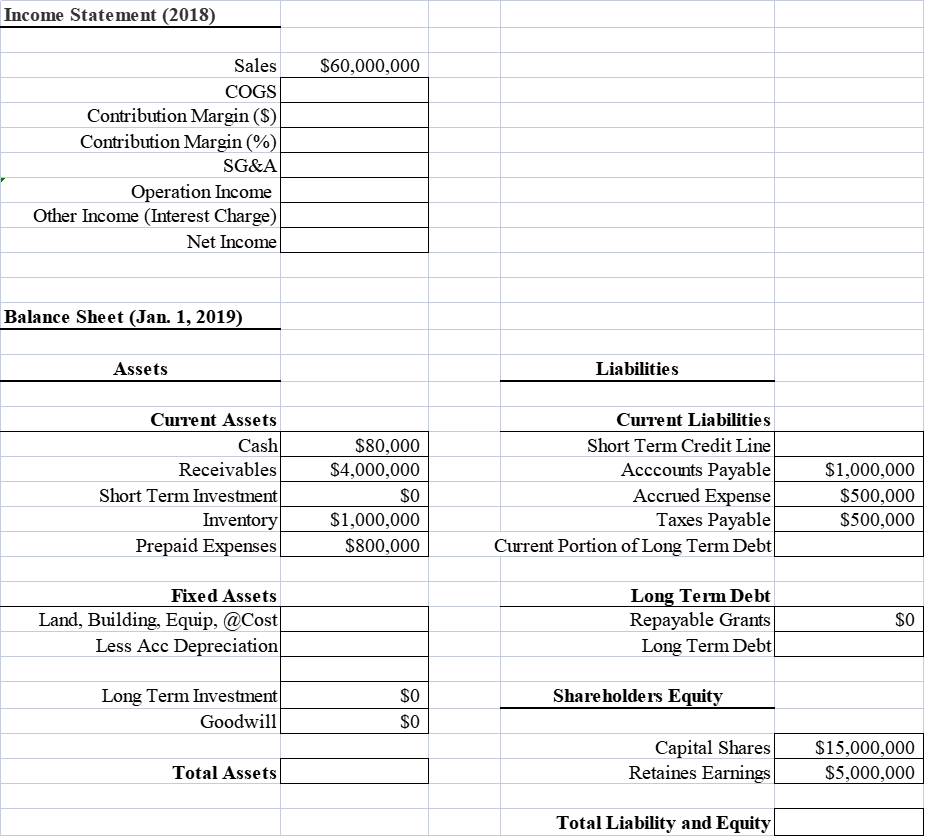

Question: Data about 2018 income statement (from Jan. 18, 201 to Dec. 31, 2018) and balance sheet (as of Jan. 1, 2019) of XYZ company is

Data about 2018 income statement (from Jan. 18, 201 to Dec. 31, 2018) and balance sheet (as of Jan. 1, 2019) of XYZ company is provided in the following. Also known that XYZ company started on Jan. 1, 2016, with a total cost of $100 Million in the fixed assets ( land, buildings and equipment), among which $20 Million is buildings and $30 Million is equipment. XYZ company depreciates the buildings on a 50-year straight-line schedule and the equipment on a 10-year straight-line schedule with no salvage value at the end of the service life. On Jan. 1, 2016, XYZ company borrowed a long-term debt of $100 Million which is repaid over a 10-year period with equal annual repayment of the loan principal. The annual interest rate of the loan is 10%. Assumed COGS = 40% sales, and SG&A (excluding depreciation) = 5% sales in the income statement below.

Answer the blank cell in below.

Income Statement (2018) Sales COGS Contribution Margin ($) Contribution Margin (%) SG&A Operation Income Other Income (Interest Charge) Net Income Balance Sheet (Jan. 1, 2019) Assets Current Assets Cash Receivables Short Term Investment Inventory Prepaid Expenses Fixed Assets Land, Building, Equip, @Cost Less Acc Depreciation Long Term Investment Goodwill Total Assets $60,000,000 $80,000 $4,000,000 $0 $1,000,000 $800,000 $0 $0 Liabilities Current Liabilities Short Term Credit Line Acccounts Payable Accrued Expense Taxes Payable Current Portion of Long Term Debt Long Term Debt Repayable Grants Long Term Debt Shareholders Equity Capital Shares Retaines Earnings Total Liability and Equity $1,000,000 $500,000 $500,000 $0 $15,000,000 $5,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts