Question: Data analytics can be used to understand return on investment. Problem Valencia Canseco was recently promoted to division director of the East Division of the

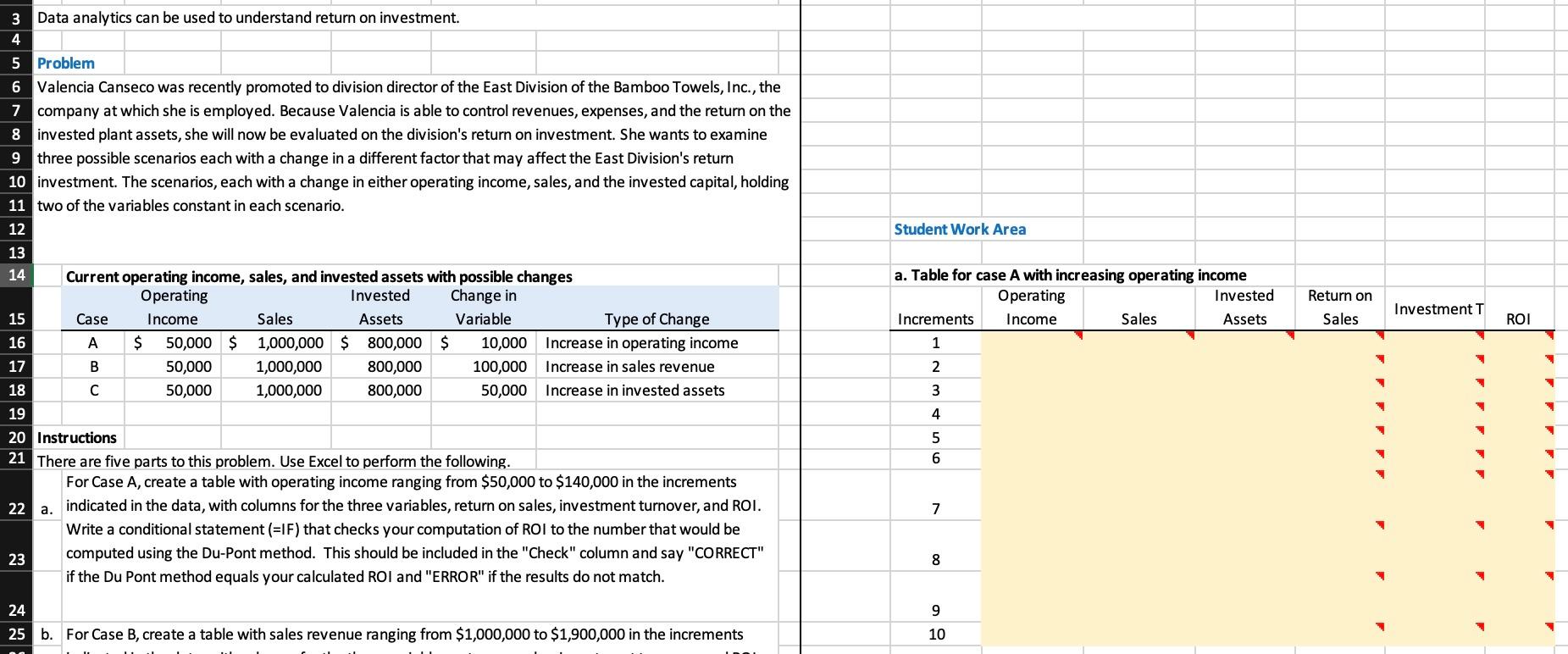

Data analytics can be used to understand return on investment. Problem Valencia Canseco was recently promoted to division director of the East Division of the Bamboo Towels, Inc., the company at which she is employed. Because Valencia is able to control revenues, expenses, and the return on the invested plant assets, she will now be evaluated on the division's return on investment. She wants to examine three possible scenarios each with a change in a different factor that may affect the East Division's return investment. The scenarios, each with a change in either operating income, sales, and the invested capital, holding two of the variables constant in each scenario. Instructions There are five parts to this problem. Use Excel to perform the following. For Case A, create a table with operating income ranging from $50,000 to $140,000 in the increments a. indicated in the data, with columns for the three variables, return on sales, investment turnover, and ROI. Write a conditional statement (=IF) that checks your computation of ROI to the number that would be computed using the Du-Pont method. This should be included in the "Check" column and say "CORRECT" if the Du Pont method equals your calculated ROI and "ERROR" if the results do not match. b. For Case B, create a table with sales revenue ranging from $1,000,000 to $1,900,000 in the increments Data analytics can be used to understand return on investment. Problem Valencia Canseco was recently promoted to division director of the East Division of the Bamboo Towels, Inc., the company at which she is employed. Because Valencia is able to control revenues, expenses, and the return on the invested plant assets, she will now be evaluated on the division's return on investment. She wants to examine three possible scenarios each with a change in a different factor that may affect the East Division's return investment. The scenarios, each with a change in either operating income, sales, and the invested capital, holding two of the variables constant in each scenario. Instructions There are five parts to this problem. Use Excel to perform the following. For Case A, create a table with operating income ranging from $50,000 to $140,000 in the increments a. indicated in the data, with columns for the three variables, return on sales, investment turnover, and ROI. Write a conditional statement (=IF) that checks your computation of ROI to the number that would be computed using the Du-Pont method. This should be included in the "Check" column and say "CORRECT" if the Du Pont method equals your calculated ROI and "ERROR" if the results do not match. b. For Case B, create a table with sales revenue ranging from $1,000,000 to $1,900,000 in the increments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts