Question: Data Case (Chapter 6) 3. Find tha currant bond rating for Ford Motor Co. Go to Standard & Poor's Wab site. Solact your country. Look

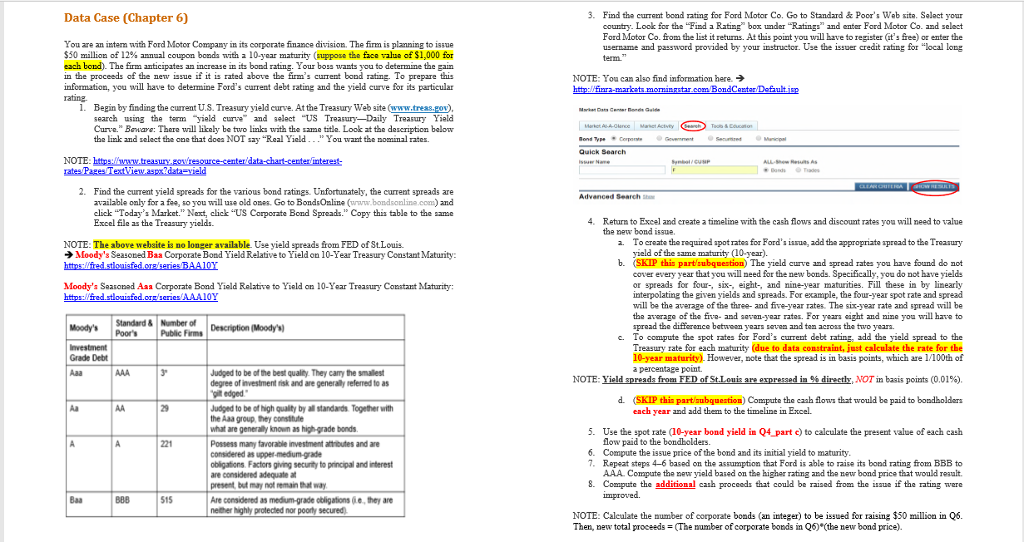

Data Case (Chapter 6) 3. Find tha currant bond rating for Ford Motor Co. Go to Standard & Poor's Wab site. Solact your country. Look for the "Find Rating>, box under "Rating;" and enter Ford Motor Co. and select Ford Motor Co. from the list it returns. At this point you will have to register t's free) or enter the username and password provided by your instructor. Use the issuer credit rating for "local long term You are an intem with Ford Motor Companyin its corporate finance division. The finm is planning to issue $50 million of 12% annual coupon bonda with a 10-year maturity (suppose the fce value of $1,000 for each bond). The firm anticipates an increase in its bond rating. Your boss wants you to determine the gain in the proceeds of the ne issue if it is rated above tbe firms current bond rating. To prepare this information, you will have to determine Ford's eurrent debt rating and the yield curve for its particular NOTE: TYou can also find information here. ratine 1. Begin by finding the current U.S. Treasury yield curve. At the Treasury Web site (www.treas,poy) search using the term yildcuvandlect "US Treasury-DailyTrYiald Curre." Baar: There will likely be two links with the same title. Look at the dascription below the lmk and select the ona that does NOT say "Real Yield." You want the nominal rates. Send y 2. Find the current yield spreads for the various bond ratings Unfortunately, the curment spreads are vailable only for a foe, so you will use old opes. Go to BondsOmline (www.bondsonline.com) and click "Today's Mirket. Net, click US Corporate Bond Spreads." Copy this table to the same Excel file as the Treaaury yields. 4. Return to Excel and create a timeline with the cash flows and discount rates you will need to value the new bond issue NOTE: The above website is no longer available. Use yield spreads from FED of StLouis. a. To create the roquirad apot ratea for Ford'sisu, add the appropriate sproad to tho Treasury Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity: yield of the same maturity (10-year). b. SKIP this partsubquestion) The yield curve and spread rates you have found do not cover every year that you will need for the new bonds. Specifically, you do not have yields or spreads for four-, six-, eight, and nine-year maturities. Fill these in by linearly interpolating the given yields and spreads. For example, the four-year spot rate and spread will be the average of the three- and five-yearts The six-year rate and spread will be tha avrage of the five- and sen-year ratos. For yeara sight and nine you will have to Moody's Saasonad Aaa Corporate Bond Yiold Rolative to Yiald on 10-Year Troasury Constant Maturity spread the difference between year"even and ten across the two years. Por's Public Firms Description (Moody's c. To compute the spot rates for Ford's current debt rating, add the yield spread to the Treasury rate for each maturity (due to data constraint, just calculate the rate for the 10-year maturity). However, note that the spread is in basis points, which are l/100th of Grade Debt a percentage pount. Judged to be of the best quality. They carry the smallest degree of investment fisk and are generaly referred to as NOTE NOT in basis points (0.01%). t edged d- (SKIP this partaubquestion) Compute the cash flows that would be paid to bondholders 29 Judged to be of high quality by all standands Together with the Aaa group, they consitute what are generality known as high-grade bonds Possess many favorable investment atthibutes and are each year and add them to the timeline in Excel. 5. Use the spot rate (10-year bond yield in Q4 part ) to caleulate the present value of each cash low paid to the bondbolders. 6. Compute the issue price of the bond and its initial yield to maturity 7. Repeat stepa 4-6 based on the assumption that Ford is able to raise its bond rating from BBB to 221 obligations. Factors giving security to principal and interest are considered adequate at present, but may not remain that way AAA Compute the nor yield based on the higher rating and the new bond price that would reault 8. Compute the additional cash proceeds that could be raised from the isaue if the ratingre 515 Are considened as medium-grade doligations (e they are nether highly protected nor poorly secured) NOTE: Caleulate the mumber of corporate bonds (an integer) to be issued for raising $50 million in Q6 Then, new total proceeds Theumber of corporate bonds in Q6)(tbe new bond price). Data Case (Chapter 6) 3. Find tha currant bond rating for Ford Motor Co. Go to Standard & Poor's Wab site. Solact your country. Look for the "Find Rating>, box under "Rating;" and enter Ford Motor Co. and select Ford Motor Co. from the list it returns. At this point you will have to register t's free) or enter the username and password provided by your instructor. Use the issuer credit rating for "local long term You are an intem with Ford Motor Companyin its corporate finance division. The finm is planning to issue $50 million of 12% annual coupon bonda with a 10-year maturity (suppose the fce value of $1,000 for each bond). The firm anticipates an increase in its bond rating. Your boss wants you to determine the gain in the proceeds of the ne issue if it is rated above tbe firms current bond rating. To prepare this information, you will have to determine Ford's eurrent debt rating and the yield curve for its particular NOTE: TYou can also find information here. ratine 1. Begin by finding the current U.S. Treasury yield curve. At the Treasury Web site (www.treas,poy) search using the term yildcuvandlect "US Treasury-DailyTrYiald Curre." Baar: There will likely be two links with the same title. Look at the dascription below the lmk and select the ona that does NOT say "Real Yield." You want the nominal rates. Send y 2. Find the current yield spreads for the various bond ratings Unfortunately, the curment spreads are vailable only for a foe, so you will use old opes. Go to BondsOmline (www.bondsonline.com) and click "Today's Mirket. Net, click US Corporate Bond Spreads." Copy this table to the same Excel file as the Treaaury yields. 4. Return to Excel and create a timeline with the cash flows and discount rates you will need to value the new bond issue NOTE: The above website is no longer available. Use yield spreads from FED of StLouis. a. To create the roquirad apot ratea for Ford'sisu, add the appropriate sproad to tho Treasury Moody's Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity: yield of the same maturity (10-year). b. SKIP this partsubquestion) The yield curve and spread rates you have found do not cover every year that you will need for the new bonds. Specifically, you do not have yields or spreads for four-, six-, eight, and nine-year maturities. Fill these in by linearly interpolating the given yields and spreads. For example, the four-year spot rate and spread will be the average of the three- and five-yearts The six-year rate and spread will be tha avrage of the five- and sen-year ratos. For yeara sight and nine you will have to Moody's Saasonad Aaa Corporate Bond Yiold Rolative to Yiald on 10-Year Troasury Constant Maturity spread the difference between year"even and ten across the two years. Por's Public Firms Description (Moody's c. To compute the spot rates for Ford's current debt rating, add the yield spread to the Treasury rate for each maturity (due to data constraint, just calculate the rate for the 10-year maturity). However, note that the spread is in basis points, which are l/100th of Grade Debt a percentage pount. Judged to be of the best quality. They carry the smallest degree of investment fisk and are generaly referred to as NOTE NOT in basis points (0.01%). t edged d- (SKIP this partaubquestion) Compute the cash flows that would be paid to bondholders 29 Judged to be of high quality by all standands Together with the Aaa group, they consitute what are generality known as high-grade bonds Possess many favorable investment atthibutes and are each year and add them to the timeline in Excel. 5. Use the spot rate (10-year bond yield in Q4 part ) to caleulate the present value of each cash low paid to the bondbolders. 6. Compute the issue price of the bond and its initial yield to maturity 7. Repeat stepa 4-6 based on the assumption that Ford is able to raise its bond rating from BBB to 221 obligations. Factors giving security to principal and interest are considered adequate at present, but may not remain that way AAA Compute the nor yield based on the higher rating and the new bond price that would reault 8. Compute the additional cash proceeds that could be raised from the isaue if the ratingre 515 Are considened as medium-grade doligations (e they are nether highly protected nor poorly secured) NOTE: Caleulate the mumber of corporate bonds (an integer) to be issued for raising $50 million in Q6 Then, new total proceeds Theumber of corporate bonds in Q6)(tbe new bond price)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts