Question: Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market value

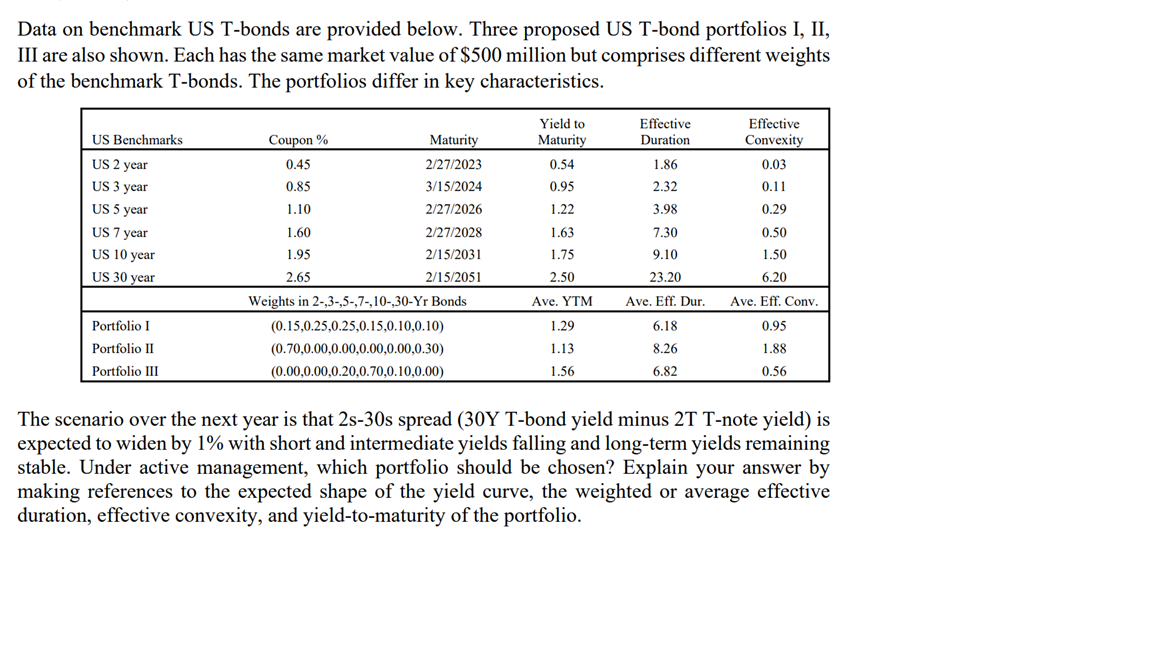

Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market value of $500 million but comprises different weights of the benchmark T-bonds. The portfolios differ in key characteristics. Yield to Maturity US Benchmarks Effective Duration 0.54 Effective Convexity 0.03 0.11 0.29 0.95 1.22 US 2 year US 3 year US 5 year US 7 year US 10 year US 30 year Coupon % Maturity 0.45 2/27/2023 0.85 3/15/2024 1.10 2/27/2026 1.60 2/27/2028 1.95 2/15/2031 2.65 2/15/2051 Weights in 2-,3-,5-,7-,10-,30-Yr Bonds (0.15,0.25,0.25,0.15,0.10,0.10) (0.70,0.00,0.00,0.00,0.00,0.30) (0.00,0.00,0.20,0.70,0.10,0.00) 1.86 2.32 3.98 7.30 9.10 23.20 1.63 1.75 0.50 1.50 2.50 6.20 Ave. YTM Ave. Eff. Dur. Ave. Eff. Conv. 6.18 Portfolio I Portfolio II Portfolio III 1.29 1.13 1.56 0.95 1.88 8.26 6.82 0.56 The scenario over the next year is that 25-30s spread (30Y T-bond yield minus 2T T-note yield) is expected to widen by 1% with short and intermediate yields falling and long-term yields remaining stable. Under active management, which portfolio should be chosen? Explain your answer by making references to the expected shape of the yield curve, the weighted or average effective duration, effective convexity, and yield-to-maturity of the portfolio. Data on benchmark US T-bonds are provided below. Three proposed US T-bond portfolios I, II, III are also shown. Each has the same market value of $500 million but comprises different weights of the benchmark T-bonds. The portfolios differ in key characteristics. Yield to Maturity US Benchmarks Effective Duration 0.54 Effective Convexity 0.03 0.11 0.29 0.95 1.22 US 2 year US 3 year US 5 year US 7 year US 10 year US 30 year Coupon % Maturity 0.45 2/27/2023 0.85 3/15/2024 1.10 2/27/2026 1.60 2/27/2028 1.95 2/15/2031 2.65 2/15/2051 Weights in 2-,3-,5-,7-,10-,30-Yr Bonds (0.15,0.25,0.25,0.15,0.10,0.10) (0.70,0.00,0.00,0.00,0.00,0.30) (0.00,0.00,0.20,0.70,0.10,0.00) 1.86 2.32 3.98 7.30 9.10 23.20 1.63 1.75 0.50 1.50 2.50 6.20 Ave. YTM Ave. Eff. Dur. Ave. Eff. Conv. 6.18 Portfolio I Portfolio II Portfolio III 1.29 1.13 1.56 0.95 1.88 8.26 6.82 0.56 The scenario over the next year is that 25-30s spread (30Y T-bond yield minus 2T T-note yield) is expected to widen by 1% with short and intermediate yields falling and long-term yields remaining stable. Under active management, which portfolio should be chosen? Explain your answer by making references to the expected shape of the yield curve, the weighted or average effective duration, effective convexity, and yield-to-maturity of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts