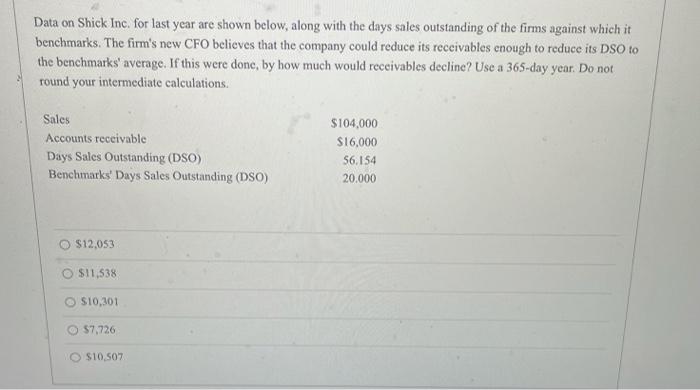

Question: Data on Shick Inc. for last year are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's

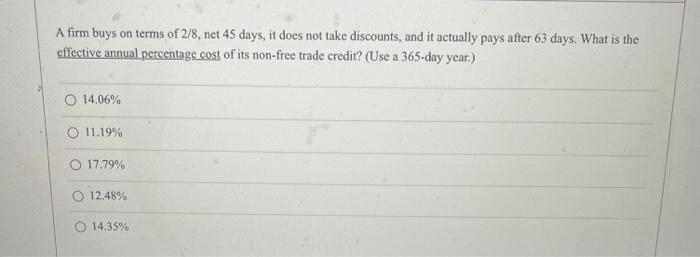

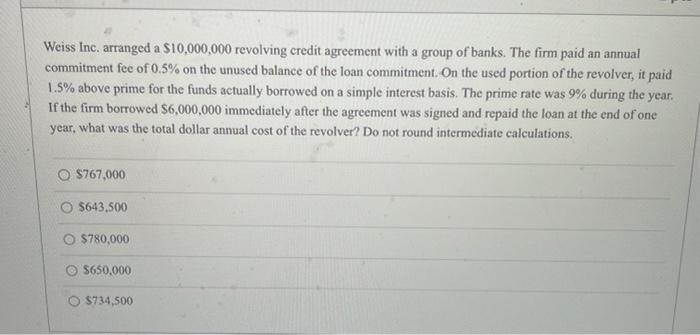

Data on Shick Inc. for last year are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average. If this were done, by how much would receivables decline? Use a 365-day year. Do not round your intermediate calculations. Sales Accounts receivable Days Sales Outstanding (DSO) Benchmarks' Days Sales Outstanding (DSO) $104,000 $16.000 56.154 20.000 $12,053 $11,538 $10,301 57,726 $10.507 A firm buys on terms of 2/8, net 45 days, it does not take discounts, and it actually pays after 63 days. What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year.) O 14.06% O 11.19% O 17.79% 12.48% 14.35% Weiss Inc. arranged a $10,000,000 revolving credit agreement with a group of banks. The firm paid an annual commitment fee of 0.5% on the unused balance of the loan commitment. On the used portion of the revolver, it paid 1.5% above prime for the funds actually borrowed on a simple interest basis. The prime rate was 9% during the year. If the firm borrowed 56,000,000 immediately after the agreement was signed and repaid the loan at the end of one year, what was the total dollar annual cost of the revolver? Do not round intermediate calculations. O $767,000 O $643,500 $780,000 $650,000 O $734,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts