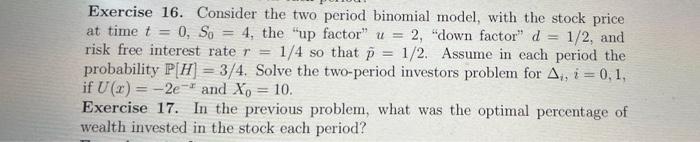

Question: Exercise 17 please Exercise 16. Consider the two period binomial model, with the stock price at time t=0,S0=4, the up factor u=2, down factor d=1/2,

Exercise 16. Consider the two period binomial model, with the stock price at time t=0,S0=4, the "up factor" u=2, "down factor" d=1/2, and risk free interest rate r=1/4 so that p~=1/2. Assume in each period the probability P[H]=3/4. Solve the two-period investors problem for i,i=0,1, if U(x)=2ex and X0=10. Exercise 17. In the previous problem, what was the optimal percentage of wealth invested in the stock each period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts