Question: Data Question: Fill out traditional overhead allocation system Use exhibit 5 to fill out activity based costing chart: Is there a different in costs between

Data

Question:

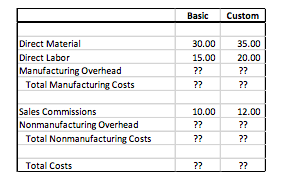

Fill out traditional overhead allocation system

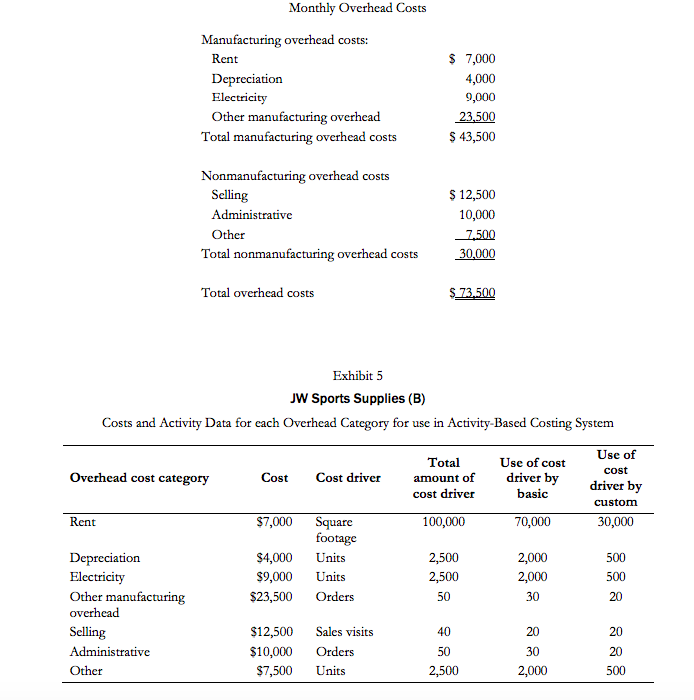

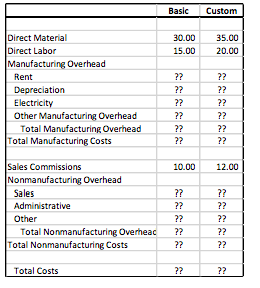

Use exhibit 5 to fill out activity based costing chart:

Is there a different in costs between traditional overhead allocation and activity based costing? Why?

*** please show calculations of overhead ***

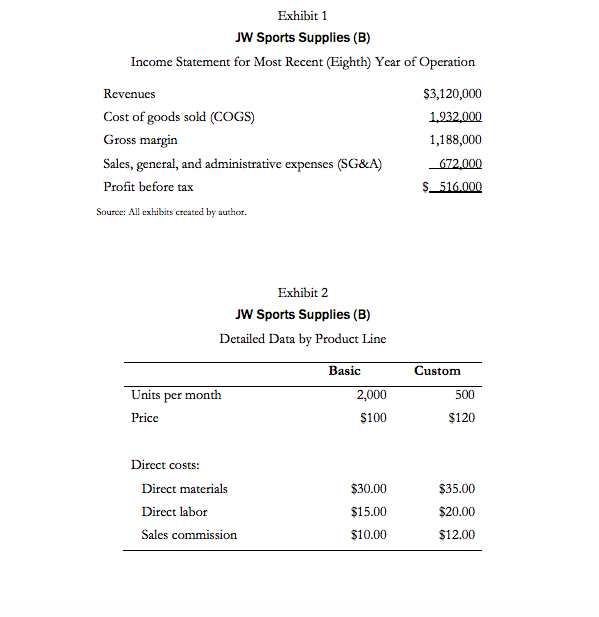

Exhibit 1 JW Sports Supplies (B) Income Statement for Most Recent (Eighth) Year of Operation Revenues Cost of goods sold (COGS) Gross margin Sales, general, and administrative expenses (SG&A) Profit before tax $3,120,000 1932.000 1,188,000 672,000 Source: All exhibits created by author Exhibit 2 JW Sports Supplies (B) Detailed Data by Product Line Basi Custom Units per month Price 2,000 500 $100 $120 Direct costs Direct materials Direct labor Sales commission $30.00 $15.00 $10.00 $35.00 $20.00 $12.00 Monthly Overhcad Costs Manufacturing overhead costs: Rent Depreciation Electricity Other manufacturing overhead $ 7,000 4,000 9,000 Total manufacturing overhcad costs 43,500 Nonmanufacturing overhead costs Selling Administrative 12,500 10,000 Total nonmanufacturing overhead costs 30,000 Total overhead costs Exhibit 5 JW Sports Supplies (B) Costs and Activity Data for each Overhead Category for use in Activity-Based Costing System Total cost driver 100,000 Use of cost driver by custom 30,000 Use of cost Overhead cost category Cost Cost driver amount ofdriver bv basic Rent $7,000 Square 70,000 footage Depreciation Electricity Other manufacturing $4,000Units $9,000Units $23,500 Orders 500 500 20 50 S12,500Sales visits 20 20 20 500 Administrative $10,000 Orders $7,500 Units 2,500 BasicCustom Direct Material Direct Labor Manufacturing Overhead 30.00 15.00 7? 35.00 20.00 Total Manufacturing Costs Sales Commissions Nonmanufacturing Overhead 10.00 12.00 Total Nonmanufacturing Costs 7? Total Costs 7? BasicCustom Direct Material Direct Labor 30.0035.00 5.0020.00 Manufacturing Overhead Rent Depreciation Electricity Other Manufacturing Overhead ?? 2 ?? 2 ?? 2 Total Manufacturing Overhead??? Total Manufacturing Costs Sales Commissions Nonmanufacturing Overhead 10.00 12.00 Sales Administrative Other 2? 2?2 2??2 Total Nonmanufacturing Overheac2 Total Nonmanufacturing Costs Total Costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts