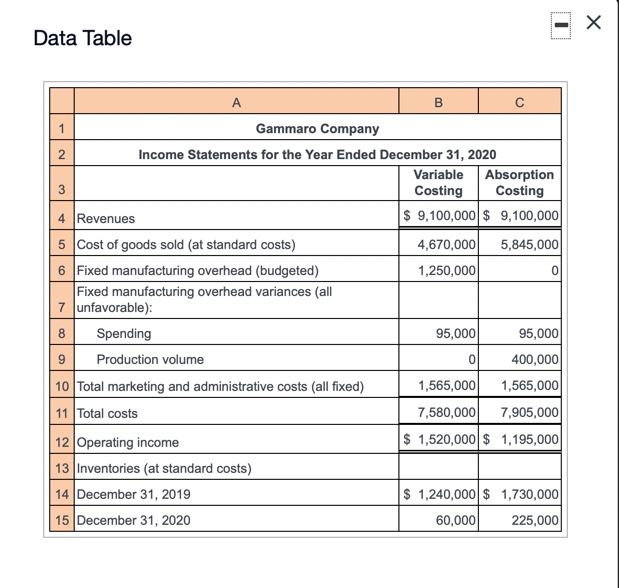

Question: Data Table 12 3 4 Revenues A B C Gammaro Company Income Statements for the Year Ended December 31, 2020 5 Cost of goods

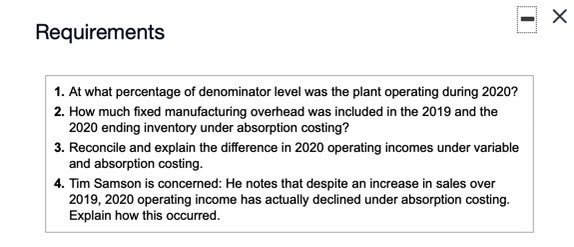

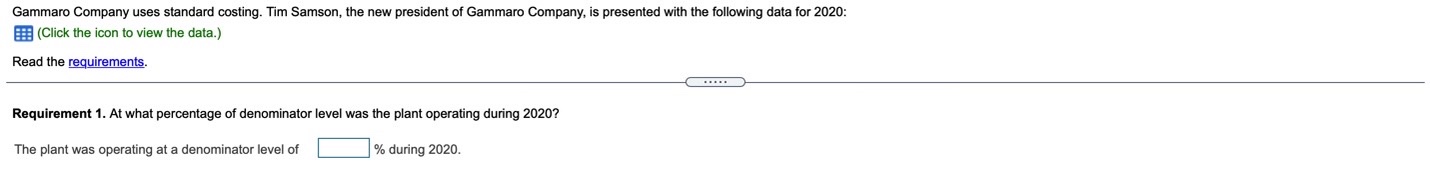

Data Table 12 3 4 Revenues A B C Gammaro Company Income Statements for the Year Ended December 31, 2020 5 Cost of goods sold (at standard costs) 6 Fixed manufacturing overhead (budgeted) Fixed manufacturing overhead variances (all 7 unfavorable): 8 Spending 6 Production volume 10 Total marketing and administrative costs (all fixed) 11 Total costs 12 Operating income 13 Inventories (at standard costs) 14 December 31, 2019 15 December 31, 2020 Variable Costing Absorption Costing $ 9,100,000 $9,100,000 4,670,000 5,845,000 1,250,000 95,000 95,000 0 400,000 1,565,000 1,565,000 7,580,000 7,905,000 $ 1,520,000 $1,195,000 $ 1,240,000 $ 1,730,000 60,000 225,000 Requirements 1. At what percentage of denominator level was the plant operating during 2020? 2. How much fixed manufacturing overhead was included in the 2019 and the 2020 ending inventory under absorption costing? 3. Reconcile and explain the difference in 2020 operating incomes under variable and absorption costing. 4. Tim Samson is concerned: He notes that despite an increase in sales over 2019, 2020 operating income has actually declined under absorption costing. Explain how this occurred. Requirements 1. At what percentage of denominator level was the plant operating during 2020? 2. How much fixed manufacturing overhead was included in the 2019 and the 2020 ending inventory under absorption costing? 3. Reconcile and explain the difference in 2020 operating incomes under variable and absorption costing. 4. Tim Samson is concerned: He notes that despite an increase in sales over 2019, 2020 operating income has actually declined under absorption costing. Explain how this occurred. Gammaro Company uses standard costing. Tim Samson, the new president of Gammaro Company, is presented with the following data for 2020: (Click the icon to view the data.) Read the requirements. Requirement 1. At what percentage of denominator level was the plant operating during 2020? The plant was operating at a denominator level of % during 2020.

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Answer 1 To determine the percentage of denominator level at which the plant was operating during 2020 we need to calculate the capacity utilization rate The denominator level represents the maximum c... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

6642d14c0522c_973896.pdf

180 KBs PDF File

6642d14c0522c_973896.docx

120 KBs Word File