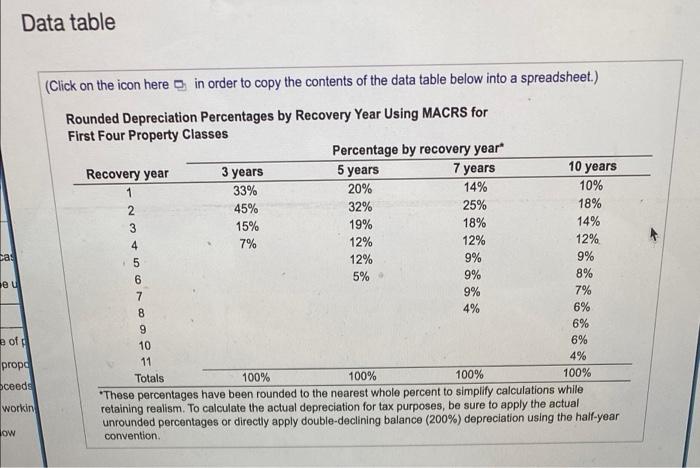

Question: Data table 7 years 10 years (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

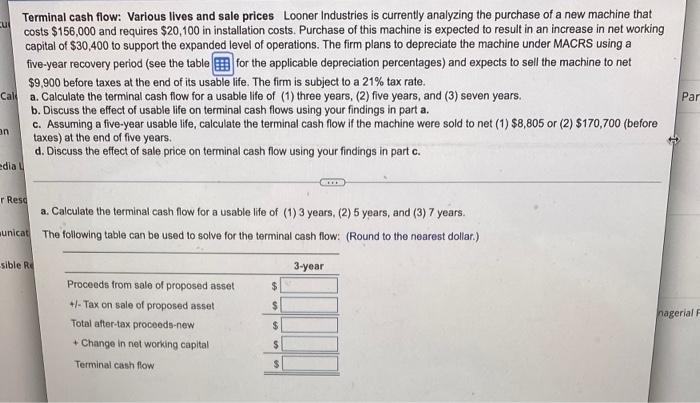

Data table 7 years 10 years (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 15% 19% 18% 14% 7% 12% 12% 12% 5 12% 9% 9% 5% 9% 8% 9% 7% 4% 6% 6% of 10 6% 4% propa 11 Totals 100% 100% 100% 100% ceeds *These percentages have been rounded to the nearest whole percent to simplify calculations while workin retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year low convention cas von WN reu cu Terminal cash flow: Various lives and sale prices Looner Industries is currently analyzing the purchase of a new machine that costs $156,000 and requires $20,100 in installation costs. Purchase of this machine is expected to result in an increase in net working capital of $30,400 to support the expanded level of operations. The firm plans to depreciate the machine under MACRS using a five-year recovery period (see the table for the applicable depreciation percentages) and expects to sell the machine to net $9,900 before taxes at the end of its usable life. The firm is subject to a 21% tax rate. Cak a. Calculate the terminal cash flow for a usable life of (1) three years, (2) five years, and (3) seven years. b. Discuss the effect of usable life on terminal cash flows using your findings in part a. c. Assuming a five-year usable life, calculate the terminal cash flow if the machine were sold to net (1) $8,805 or (2) $170,700 (before taxes) at the end of five years. d. Discuss the effect of sale price on terminal cash flow using your findings in part c. dia Par an r Resc a. Calculate the terminal cash flow for a usable life of (1) 3 years, (2) 5 years, and (3) 7 years. municat The following table can be used to solve for the terminal cash flow: (Round to the nearest dollar) sible R 3-year $ $ Proceeds from sale of proposed asset +/- Tax on sale of proposed asset Total after-tax proceeds-new + Change in net working capital nagerial $ $ Terminal cash flow $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts