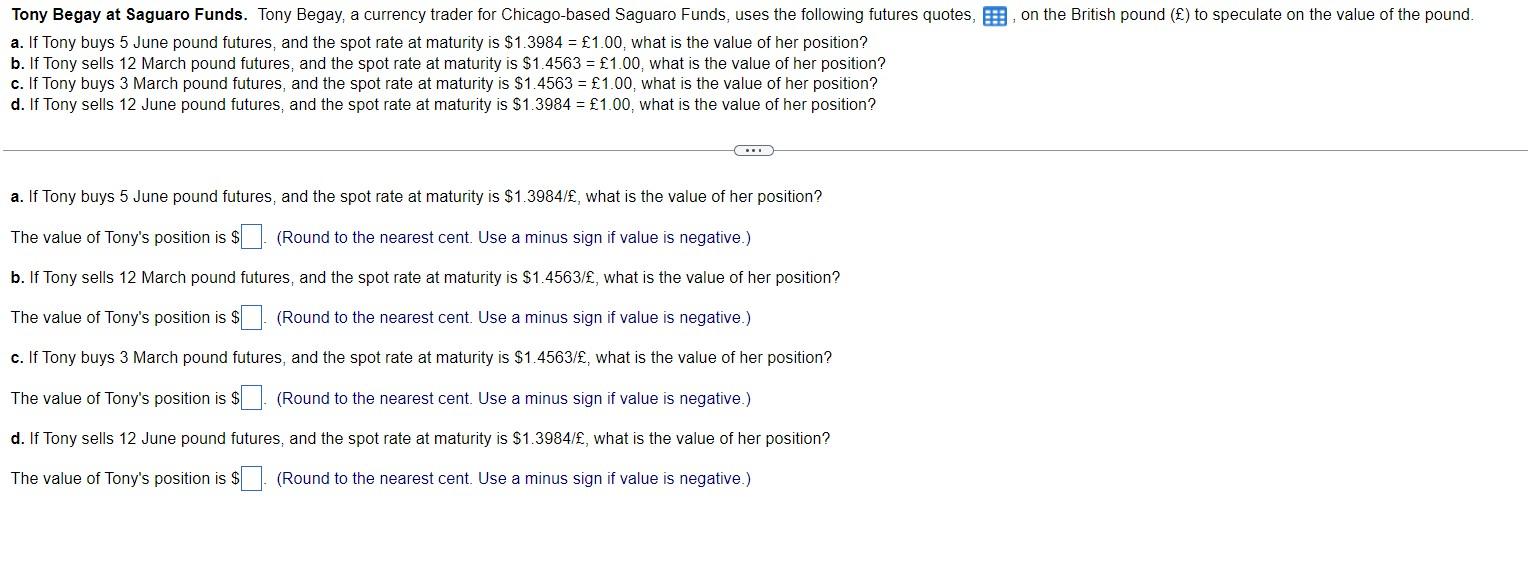

Question: Data table (Click on the following icon in order to copy its contents into a spreadsheet.) British Pound Futures, $=1.00 (CME) Tony Begay at Saguaro

Data table (Click on the following icon in order to copy its contents into a spreadsheet.) British Pound Futures, $=1.00 (CME) Tony Begay at Saguaro Funds. Tony Begay, a currency trader for Chicago-based Saguaro Funds, uses the following futures quotes, , on the British pound ( ) to speculate on the value of the pound. a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3984=1.00, what is the value of her position? b. If Tony sells 12 March pound futures, and the spot rate at maturity is $1.4563=1.00, what is the value of her position? c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4563=1.00, what is the value of her position? d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3984=1.00, what is the value of her position? a. If Tony buys 5 June pound futures, and the spot rate at maturity is $1.3984/, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) b. If Tony sells 12 March pound futures, and the spot rate at maturity is $1.4563/E, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) c. If Tony buys 3 March pound futures, and the spot rate at maturity is $1.4563/E, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.) d. If Tony sells 12 June pound futures, and the spot rate at maturity is $1.3984/, what is the value of her position? The value of Tony's position is $ (Round to the nearest cent. Use a minus sign if value is negative.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts