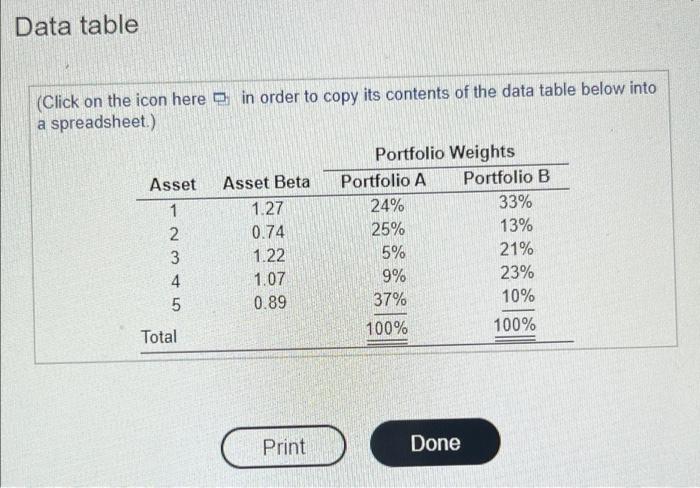

Question: Data table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Portfolio Weights Asset Asset

Data table (Click on the icon here in order to copy its contents of the data table below into a spreadsheet.) Portfolio Weights Asset Asset Beta Portfolio A 1 1.27 24% 0.74 25% 1.22 5% 1.07 9% 0.89 37% 100% 2345 Total Print Done Portfolio B 33% 13% 21% 23% 10% 100% Jason Jackson is attempting to evaluate the possible portfoles consisting of the same five asts but held in different proportions. He is particularly in using beta to pare the of the ports and in Pis regard, hes gathered the towing date a. Calculate the betas for portfolios A and B b. Compare the risk of each porthlis to the market as well as to each other which portfolio is more risky? a. The beta of portfolio Al(Round to mree decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts